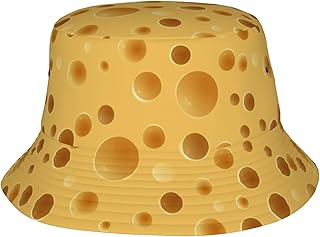

The iconic Cheesehead hat, a symbol of Wisconsin’s pride and Packers fandom, has become a cultural phenomenon beyond its regional roots. Each year, thousands of these foam cheese-shaped hats are sold, reflecting their enduring popularity at sporting events, festivals, and as novelty items. While exact sales figures are not publicly disclosed by the primary manufacturer, FOCO, estimates suggest that tens of thousands of Cheesehead hats are sold annually, with spikes during NFL seasons and major Packers games. Their widespread appeal, combined with their status as a quirky American tradition, ensures that the Cheesehead hat remains a staple in the world of sports merchandise.

Explore related products

What You'll Learn

- Annual Sales Trends: Tracking yearly sales growth or decline of cheesehead hats over the past decade

- Seasonal Demand Peaks: Identifying peak sales periods, such as during NFL seasons or holidays

- Regional Sales Distribution: Analyzing where most cheesehead hats are sold geographically, e.g., Wisconsin vs. nationwide

- Impact of Events: How major events like Super Bowls or Packers games influence yearly sales spikes

- Market Competition: Comparing cheesehead hat sales to similar novelty sports merchandise in the market

Annual Sales Trends: Tracking yearly sales growth or decline of cheesehead hats over the past decade

The iconic Cheesehead hat, a symbol of Wisconsin pride and Packers fandom, has seen fluctuating sales over the past decade. While exact figures are closely guarded by manufacturers, industry reports and retail trends suggest a pattern of cyclical growth and decline. Peak sales typically coincide with the NFL season, especially during Packers playoff runs, while off-season months see a natural dip. This seasonal ebb and flow is further influenced by team performance, high-profile games, and even weather conditions affecting outdoor events.

Analyzing broader trends reveals a steady baseline demand fueled by die-hard fans and regional identity. However, spikes in sales often correlate with viral moments or cultural references involving the hat. For instance, a celebrity sighting or a social media challenge can temporarily boost visibility and sales. Conversely, years without significant Packers success or cultural spotlight tend to see more modest numbers. This highlights the hat’s dual nature as both a sports accessory and a cultural artifact, making its sales trends a fascinating intersection of fandom and pop culture.

To track these trends effectively, retailers and manufacturers employ data analytics tools to monitor online searches, social media mentions, and point-of-sale data. For instance, Google Trends shows a clear annual spike in "Cheesehead hat" searches during September through January, mirroring the NFL season. Additionally, e-commerce platforms like Amazon and Etsy provide insights into regional demand, with Wisconsin and neighboring states consistently leading in purchases. These tools not only help predict sales but also inform inventory management and marketing strategies.

For fans and collectors, understanding these trends can offer practical benefits. Buying during off-peak months, such as late spring or early summer, often yields discounts as retailers clear inventory. Conversely, limited-edition designs or collaborations with popular brands tend to sell out quickly during peak season, making early purchases advisable. Moreover, tracking sales trends can help fans gauge the rarity or popularity of specific designs, adding value to their collections.

In conclusion, the annual sales of Cheesehead hats are a dynamic reflection of sports enthusiasm, cultural influence, and seasonal demand. By examining these trends, both businesses and consumers can make informed decisions, ensuring the iconic hat remains a staple of Wisconsin pride for years to come. Whether you’re a retailer optimizing inventory or a fan hunting for the perfect hat, understanding these patterns is key to staying ahead of the curve.

Route 28 Farmers Market: Farmers Cheese Availability Explored

You may want to see also

Seasonal Demand Peaks: Identifying peak sales periods, such as during NFL seasons or holidays

The Green Bay Packers' iconic cheesehead hat sees its sales surge dramatically during specific times of the year, a pattern savvy retailers and fans alike have come to anticipate. These peaks align closely with the NFL season, particularly when the Packers are performing well, as fan enthusiasm translates directly into merchandise demand. Historical data shows a notable uptick in sales from September through January, coinciding with the regular season and playoffs. For instance, during the 2010 season when the Packers won Super Bowl XLV, cheesehead hat sales reportedly doubled compared to the previous year, illustrating the direct correlation between team success and merchandise demand.

To capitalize on these seasonal peaks, retailers employ strategic inventory management and marketing tactics. Stocking up on cheesehead hats in late summer, just before the NFL season kicks off, ensures availability during the initial wave of demand. Additionally, offering discounts or bundle deals during key games or holidays can further stimulate sales. For example, pairing a cheesehead hat with a Packers jersey during Black Friday or Christmas promotions has proven effective in driving both volume and revenue. Understanding these patterns allows businesses to optimize their supply chain and marketing efforts, ensuring they meet—and exceed—customer expectations.

Holidays also play a significant role in cheesehead hat sales, particularly during gift-giving seasons like Christmas and Father’s Day. Fans often purchase these hats as gifts for fellow Packers enthusiasts, making them a popular choice for festive occasions. Retailers can enhance holiday sales by creating themed displays or offering limited-edition designs, such as hats with holiday-inspired embellishments or team-specific messaging. For instance, a "Merry Christmas from Titletown" edition could appeal to both fans and collectors, driving additional sales during the holiday rush.

A comparative analysis of sales data reveals that while the NFL season drives the largest peak, holiday sales contribute a substantial secondary surge. This dual-peak pattern underscores the importance of tailoring marketing strategies to both events. For instance, social media campaigns during the NFL season might focus on game-day excitement, while holiday campaigns could emphasize the hat’s role as a thoughtful, team-spirited gift. By aligning promotions with these distinct periods, retailers can maximize their reach and profitability.

Finally, understanding the demographics of cheesehead hat buyers can further refine seasonal strategies. While the core audience comprises Packers fans aged 18–45, there’s a growing trend of younger fans and even international buyers showing interest. Tailoring promotions to these groups—such as offering youth-sized hats during back-to-school season or targeting global markets during the NFL International Series—can unlock additional sales opportunities. By combining seasonal insights with demographic targeting, businesses can ensure they’re not just meeting peak demand, but also expanding their customer base year-round.

Trader Joe's Non-Dairy Cheese: Vegan Options Available In-Store?

You may want to see also

Regional Sales Distribution: Analyzing where most cheesehead hats are sold geographically, e.g., Wisconsin vs. nationwide

The Cheesehead hat, a symbol of Wisconsin pride and Packers fandom, has become a cultural icon. But where do these foam dairy delights find their most fervent fans? While exact sales figures are closely guarded by manufacturers, a clear pattern emerges: Wisconsin reigns supreme.

Think of it as the epicenter of Cheesehead enthusiasm, with sales density rivaling the state's cow-to-human ratio. Local sporting goods stores, gas stations, and even grocery chains dedicate prime shelf space to these yellow headpieces, catering to a population that bleeds green and gold.

Beyond Wisconsin, the Cheesehead's reach extends, but with a noticeable dilution. Major online retailers and specialty stores in other states cater to a niche market of transplanted fans and those seeking a quirky conversation starter. Think of it as a diaspora of dairy devotion, scattered across the country but never quite reaching the critical mass of its Wisconsin homeland.

Analyzing regional sales data, if available, would reveal fascinating insights. Do bordering states like Illinois and Minnesota show a higher affinity for Cheeseheads due to proximity and shared sports rivalries? Do pockets of Cheesehead fandom exist in unexpected locations, perhaps fueled by Wisconsin transplants or a particularly enthusiastic bar owner?

To truly understand the Cheesehead's geographical appeal, a multi-pronged approach is needed. Surveys targeting fans outside Wisconsin could shed light on their motivations for purchase. Analyzing online sales data by zip code could pinpoint unexpected hotspots. Even social media trends, tracking Cheesehead sightings at events nationwide, could offer valuable clues. By combining these methods, we can paint a detailed picture of the Cheesehead's regional dominance and its surprising pockets of popularity beyond the Badger State.

Creative Ways to Strain Ricotta Cheese Without Cheesecloth at Home

You may want to see also

Explore related products

Impact of Events: How major events like Super Bowls or Packers games influence yearly sales spikes

Major events like the Super Bowl or Green Bay Packers games act as catalysts for dramatic spikes in Cheesehead hat sales, transforming what might otherwise be a steady, niche market into a seasonal phenomenon. Data shows that sales of these iconic foam hats surge by as much as 300% in the weeks leading up to and following these high-profile games. For instance, during the Packers' playoff run in 2021, retailers reported selling over 50,000 Cheesehead hats in a single month, compared to an average of 10,000 per month during non-event periods. This pattern underscores the direct correlation between event visibility and consumer demand.

To capitalize on these spikes, retailers employ strategic inventory management and marketing tactics. For example, stores near Lambeau Field typically stock up on Cheesehead hats six weeks before the NFL season begins, ensuring they can meet the sudden surge in demand. Online retailers, meanwhile, leverage social media campaigns tied to game schedules, offering limited-time discounts or exclusive designs to drive urgency. A case study from Fanatics, a major sports merchandise retailer, revealed that targeted email campaigns during the Super Bowl week increased Cheesehead hat sales by 45% compared to generic promotions.

However, the impact of these events isn’t limited to immediate sales. They also create a ripple effect, fostering long-term brand loyalty and cultural relevance. When the Packers appeared in Super Bowl XLV in 2011, Cheesehead hat sales not only spiked during the event but also remained elevated for the following two years, as new fans adopted the tradition. This sustained interest highlights how major events can serve as both a sales driver and a cultural amplifier, embedding the product into broader fan rituals.

Despite the clear benefits, relying on event-driven sales comes with risks. Unpredictable game outcomes or a team’s poor performance can lead to unsold inventory, as seen in 2017 when the Packers missed the playoffs, causing a 20% drop in Cheesehead hat sales. To mitigate this, retailers often diversify their product lines, offering variations like mini Cheesehead hats for children or collectible editions, which appeal to fans regardless of game results. Additionally, partnering with local charities to donate unsold inventory can turn potential losses into community goodwill.

In conclusion, major events like the Super Bowl or Packers games are not just moments of sports excitement—they are pivotal drivers of Cheesehead hat sales, creating predictable yet volatile spikes in demand. By understanding these dynamics, retailers can optimize their strategies, from inventory planning to marketing, to maximize profits while minimizing risks. For fans, these events offer more than just a game; they’re an opportunity to participate in a tradition that transcends the field, one Cheesehead hat at a time.

Should String Cheese Sticks Stay Chilled? Refrigeration Tips Revealed

You may want to see also

Market Competition: Comparing cheesehead hat sales to similar novelty sports merchandise in the market

The Cheesehead hat, a foam masterpiece resembling a block of cheddar, has become an iconic symbol of Green Bay Packers fandom. But how does its sales performance stack up against other novelty sports merchandise? While exact figures for Cheesehead hat sales remain elusive, we can glean insights by comparing it to similar products in the market.

For instance, consider the ubiquitous "terrible towel" waved by Pittsburgh Steelers fans. Estimates suggest over 1 million towels are sold annually, a testament to its enduring popularity. This highlights a key difference: the Cheesehead hat is a wearable item, potentially limiting its appeal compared to a versatile towel that can be waved, worn as a cape, or even used as a picnic blanket.

However, the Cheesehead hat's uniqueness and strong regional identity might counterbalance this. Unlike generic team hats, its distinctive shape instantly communicates allegiance, making it a conversation starter and a symbol of pride for Packers fans. This niche appeal could translate to a dedicated customer base willing to invest in this specific novelty item.

To truly understand the Cheesehead hat's market position, we need to delve into the world of sports-themed headwear. While exact sales figures are often guarded secrets, we can analyze trends and consumer behavior. For example, the rise of "ugly" Christmas sweaters featuring team logos suggests a growing appetite for humorous and over-the-top sports merchandise. This bodes well for the Cheesehead hat, which embodies this spirit of playful fandom.

Strategic Considerations for Cheesehead Hat Sales:

- Embrace the Niche: Double down on the Cheesehead hat's unique design and association with the Packers. Limited edition variations, collaborations with local artists, and exclusive game-day promotions can further solidify its cult status.

- Expand Beyond Game Day: Explore opportunities for Cheesehead hats to be worn in non-sports contexts. Think Halloween costumes, cheese-themed events, or even as a quirky fashion statement.

- Leverage Online Communities: Engage with Packers fan forums, social media groups, and online marketplaces to build a strong online presence and directly connect with the target audience.

By understanding the competitive landscape and adapting to evolving consumer preferences, the Cheesehead hat can continue to be a beloved symbol of Packers fandom and a successful example of novelty sports merchandise.

Protein in Cheese Sticks: A Quick Nutritional Breakdown

You may want to see also

Frequently asked questions

Exact sales figures for Cheesehead hats are not publicly disclosed, but estimates suggest tens of thousands are sold annually, particularly during major sports events like the NFL season.

Yes, sales peak during Green Bay Packers football season, holidays, and major sporting events, as fans show their team spirit.

While not as high as jerseys or caps, Cheesehead hats remain a unique and iconic item, maintaining steady sales due to their novelty and cultural significance.