When considering the cost of importing cheese, understanding the duties imposed on it is crucial, as these fees can significantly impact the final price. Duties on cheese vary widely depending on factors such as the type of cheese, its country of origin, and the destination country’s trade agreements. For instance, the United States imposes tariffs ranging from 0% to 20% or more on imported cheese, with specific rates determined by the Harmonized Tariff Schedule. Similarly, the European Union and other regions have their own duty structures, often influenced by trade deals like the EU-Canada Comprehensive Economic and Trade Agreement (CETA), which has reduced or eliminated tariffs on certain cheeses. To accurately calculate the total cost, importers must also account for additional charges such as value-added tax (VAT) and customs processing fees. Researching the specific regulations of both the exporting and importing countries is essential to avoid unexpected expenses and ensure compliance with international trade laws.

| Characteristics | Values |

|---|---|

| Duty Rates | Vary by country and type of cheese; e.g., the US imposes up to 20% on certain cheeses, while the EU has complex tariffs ranging from 0% to 173% based on quotas and origin. |

| Country-Specific Duties | Canada: 200-245% on non-quota cheese; UK: 0-12% post-Brexit; Australia: 0-20% under trade agreements. |

| Trade Agreements | Reduced or eliminated duties under agreements like USMCA, CETA, and CPTPP. |

| Quota Systems | Tariff-rate quotas (TRQs) apply lower duties within quotas, higher duties above quotas (e.g., EU, Canada). |

| Product Classification | HS Code 0406 for cheese; subcategories determine specific duty rates. |

| Additional Taxes/Fees | Import VAT (e.g., 5% in Canada), anti-dumping duties, or processing fees may apply. |

| Recent Changes | Post-Brexit adjustments in the UK; US-EU tariff negotiations ongoing. |

| Exemptions | Organic or specialty cheeses may qualify for reduced rates in some countries. |

| Documentation | Certificates of origin, health certificates, and import licenses often required. |

| Currency Impact | Fluctuations in exchange rates can affect duty costs. |

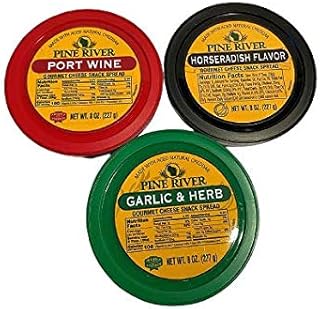

Explore related products

What You'll Learn

- Duty Rates by Country: Cheese import tariffs vary globally; check specific country regulations for accurate duty rates

- EU Cheese Duties: EU imposes tariffs on non-member cheese imports, ranging from 0% to 36%

- US Cheese Tariffs: U.S. cheese duties depend on type and origin, typically 0% to 20%

- Duty-Free Agreements: Trade deals like USMCA or CETA may eliminate or reduce cheese tariffs

- Calculating Cheese Duties: Use HS codes and customs tools to determine exact duty amounts

Duty Rates by Country: Cheese import tariffs vary globally; check specific country regulations for accurate duty rates

When considering the import of cheese, understanding the duty rates by country is crucial, as tariffs can significantly impact the final cost. Duty Rates by Country: Cheese import tariffs vary globally; check specific country regulations for accurate duty rates. For instance, the European Union (EU) imposes tariffs ranging from 0% to 176% on cheese imports, depending on the type and origin. Hard cheeses like Cheddar or Gouda often face lower tariffs compared to processed or blue cheeses. These rates are designed to protect local dairy industries while regulating international trade. Importers must consult the EU’s Taric database or local customs authorities to determine precise duties for their products.

In the United States, cheese import tariffs are equally complex, with rates ranging from 0% to 36.5%. The U.S. uses a Harmonized Tariff Schedule (HTS) to classify cheese types, with specific duties applied based on the product’s category and country of origin. For example, certain cheeses from countries with free trade agreements, like Mexico or Canada, may enter duty-free under the USMCA. However, cheeses from non-partner countries, such as those in the EU, often face higher tariffs. Importers should verify HTS codes and consult the U.S. International Trade Commission for accurate duty information.

Asian countries also have diverse cheese import tariffs, reflecting their unique trade policies. In Japan, tariffs range from 0% to 40%, with preferential rates for countries under economic partnership agreements, such as Australia or the EU. China imposes tariffs between 10% and 15% on most cheese imports, though rates can vary based on trade agreements or quotas. India, on the other hand, levies tariffs as high as 60% to protect its domestic dairy sector. Duty Rates by Country: Cheese import tariffs vary globally; check specific country regulations for accurate duty rates. Businesses must stay updated on bilateral agreements and local customs rules to avoid unexpected costs.

In Australia and New Zealand, cheese import tariffs are generally lower due to their strong dairy industries and trade agreements. Australia imposes tariffs ranging from 0% to 20%, with reduced rates for partners under agreements like the Australia-New Zealand Closer Economic Relations (ANZCER) or the Australia-Japan Economic Partnership Agreement. New Zealand, a major dairy exporter, often applies minimal or zero tariffs to cheese imports, though exceptions exist for certain products. Importers in these regions should review the relevant trade agreements and customs guidelines to ensure compliance.

Finally, in emerging markets like Brazil and South Africa, cheese import tariffs are designed to balance trade and protect local producers. Brazil imposes tariffs between 10% and 28%, with higher rates for processed cheeses. South Africa’s tariffs range from 0% to 45%, depending on the product and trade agreements. Duty Rates by Country: Cheese import tariffs vary globally; check specific country regulations for accurate duty rates. Importers must navigate these complexities by consulting local customs authorities, trade databases, or legal experts to ensure accurate duty calculations and smooth import processes.

Exploring America's Cheese Reserves: How Much Does the US Have?

You may want to see also

EU Cheese Duties: EU imposes tariffs on non-member cheese imports, ranging from 0% to 36%

The European Union (EU) has a complex system of tariffs and duties on imported goods, including cheese. When it comes to EU Cheese Duties, the bloc imposes tariffs on cheese imports from non-member countries, with rates varying significantly depending on the type of cheese, its country of origin, and existing trade agreements. These tariffs range from 0% to 36%, creating a structured barrier to protect the EU’s domestic dairy industry while also regulating international trade. For instance, cheeses from countries with preferential trade agreements, such as those in the African, Caribbean, and Pacific (ACP) group, may benefit from reduced or zero tariffs, while others face higher rates.

The EU Cheese Duties are determined by the EU’s Common Customs Tariff (CCT), which classifies products using the Harmonized System (HS) codes. Cheese is categorized under HS code 0406, with subcategories for specific types like fresh cheese, blue-veined cheese, or processed cheese. Each category has its own tariff rate, which can be ad valorem (a percentage of the product’s value) or specific (a fixed amount per unit). For example, certain hard cheeses like cheddar may face tariffs of up to 36%, while softer cheeses or those from specific regions might incur lower rates. These tariffs are designed to maintain the competitiveness of EU-produced cheeses in the internal market.

Non-member countries exporting cheese to the EU must navigate these tariffs carefully to remain price-competitive. For instance, a 36% duty on a €100 batch of cheese would add €36 to the cost, significantly impacting the final price for EU consumers. To mitigate this, some countries negotiate free trade agreements (FTAs) with the EU, which often include provisions to reduce or eliminate cheese tariffs over time. For example, the EU-Canada Comprehensive Economic and Trade Agreement (CETA) phased out tariffs on certain Canadian cheeses, while others still face duties. Understanding these agreements is crucial for exporters to optimize their market access.

The EU Cheese Duties also serve as a tool to uphold quality and safety standards. Imported cheeses must comply with EU regulations, including those related to production methods, additives, and labeling. Failure to meet these standards can result in additional fees or import refusals, regardless of the tariff rate. This dual focus on tariffs and standards ensures that imported cheeses compete fairly with EU products while safeguarding consumer interests.

In summary, EU Cheese Duties play a pivotal role in shaping the global cheese trade. With tariffs ranging from 0% to 36%, they reflect the EU’s commitment to protecting its dairy sector while engaging in international commerce. Exporters must carefully consider these duties, along with trade agreements and compliance requirements, to successfully navigate the EU market. For consumers, these tariffs influence the availability and price of non-EU cheeses, making them an essential aspect of the global dairy industry.

Understanding the Cost of Sandwich Cheese: A Comprehensive Price Guide

You may want to see also

US Cheese Tariffs: U.S. cheese duties depend on type and origin, typically 0% to 20%

When it comes to importing cheese into the United States, understanding the tariff structure is crucial for businesses and consumers alike. US Cheese Tariffs are not a one-size-fits-all scenario; instead, they vary significantly based on the type of cheese and its country of origin. Generally, these duties range from 0% to 20%, but the specifics can be more complex. For instance, cheeses from countries with which the U.S. has trade agreements, such as those under the United States-Mexico-Canada Agreement (USMCA), often enjoy reduced or zero tariffs. This makes it essential for importers to verify the applicable rates based on the product and its source.

The type of cheese plays a pivotal role in determining the tariff rate. Hard cheeses like cheddar or parmesan may face different duties compared to soft cheeses like brie or camembert. Additionally, specialty cheeses, such as those with unique aging processes or ingredients, might fall under specific tariff codes that influence the final duty amount. Importers must classify their products accurately using the Harmonized Tariff Schedule (HTS) to ensure compliance and avoid unexpected costs. Misclassification can lead to delays, penalties, or overpayment of duties.

The origin of the cheese is another critical factor in U.S. cheese duties. Cheeses from the European Union, for example, often face higher tariffs due to historical trade tensions and the absence of a comprehensive free trade agreement. In contrast, cheeses from countries like Australia or Chile, which have trade agreements with the U.S., may benefit from lower or eliminated tariffs. Importers should consult the U.S. International Trade Commission (USITC) or a customs broker to determine the exact duty rates for their specific products and origins.

It’s also important to note that U.S. cheese tariffs can be influenced by temporary trade measures or retaliatory tariffs. For instance, during trade disputes, the U.S. government may impose additional duties on certain cheeses from specific countries. Staying informed about current trade policies and updates from agencies like the Office of the United States Trade Representative (USTR) is vital for importers to navigate these fluctuations effectively.

Finally, while the typical range of U.S. cheese duties is 0% to 20%, the actual cost to importers can be higher when factoring in additional fees such as customs processing charges, merchandise processing fees, and harbor maintenance taxes. These supplementary costs can add up, making it essential for businesses to budget comprehensively. By understanding the nuances of US Cheese Tariffs, importers can optimize their supply chains, minimize costs, and ensure compliance with U.S. trade regulations.

Parmesan Cheese: Dairy Content and Nutritional Insights Explained

You may want to see also

Explore related products

Duty-Free Agreements: Trade deals like USMCA or CETA may eliminate or reduce cheese tariffs

Duty-free agreements play a pivotal role in shaping the global cheese trade by eliminating or significantly reducing tariffs, which can otherwise inflate the cost of imported cheese. Trade deals such as the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive Economic and Trade Agreement (CETA) between Canada and the European Union are prime examples of how countries collaborate to foster freer trade. Under USMCA, for instance, Canada agreed to provide greater market access to U.S. dairy products, including cheese, by creating a duty-free tariff rate quota (TRQ) for 21,750 metric tons of U.S. cheese. This quota allows U.S. cheese to enter Canada without the typical tariffs, which can range from 200% to 300% for dairy products outside of TRQs. Such agreements directly benefit consumers by lowering prices and increasing product availability.

CETA is another landmark agreement that has substantially reduced cheese tariffs, particularly between the EU and Canada. Before CETA, Canadian tariffs on EU cheese imports could reach up to 245%. The agreement phased out these tariffs over several years, creating duty-free access for a significant portion of EU cheese exports to Canada. In return, the EU granted Canada increased access to its market for certain dairy products. This reciprocal arrangement not only reduces costs for importers and consumers but also encourages greater competition and diversity in the cheese market. For businesses, understanding these duty-free provisions is crucial for optimizing supply chains and maximizing profitability.

The impact of duty-free agreements extends beyond immediate cost savings, as they often stimulate trade volumes and foster economic growth. For example, since the implementation of CETA, EU cheese exports to Canada have surged, with duty-free access enabling European producers to compete more effectively in the Canadian market. Similarly, under USMCA, U.S. cheese exports to Canada and Mexico have increased, bolstered by reduced tariffs and streamlined trade processes. These agreements also include provisions for sanitary and phytosanitary measures, ensuring that cheese products meet safety standards while minimizing unnecessary trade barriers.

However, duty-free agreements are not without challenges. Domestic producers in countries with reduced tariffs may face increased competition from foreign cheese imports, potentially impacting local industries. To mitigate this, trade deals often include transitional periods or safeguards, such as TRQs, to gradually open markets while protecting sensitive sectors. For instance, Canada’s dairy industry, which operates under a supply management system, secured TRQs and safeguards in both USMCA and CETA to balance market access with industry protection.

In conclusion, duty-free agreements like USMCA and CETA are transformative for the cheese trade, reducing or eliminating tariffs that historically inflated import costs. These agreements not only lower prices for consumers but also enhance market access for exporters, driving trade growth and product diversity. For businesses and policymakers, understanding the specifics of these deals—such as TRQs, phased tariff reductions, and safeguard measures—is essential for navigating the complexities of international cheese trade. As global trade continues to evolve, duty-free agreements will remain a cornerstone of efforts to create more open, competitive, and efficient markets for cheese and other dairy products.

Exploring the Cost of a Classic Chopped Cheese Sandwich

You may want to see also

Calculating Cheese Duties: Use HS codes and customs tools to determine exact duty amounts

When calculating cheese duties, understanding the Harmonized System (HS) codes is essential. HS codes are internationally standardized codes used to classify traded products, including cheese. Each type of cheese has a specific HS code that determines its duty rate. For example, cheddar cheese might fall under a different HS code than blue cheese, leading to variations in duty amounts. To begin, identify the correct HS code for the cheese you’re importing by consulting the HS code list provided by your country’s customs authority or using online databases like the World Customs Organization’s HS Search tool. This step ensures accuracy in duty calculations and compliance with trade regulations.

Once you have the HS code, the next step is to use customs tools to determine the exact duty amount. Many countries offer online duty calculators or tariff databases that allow you to input the HS code and other relevant details, such as the country of origin and import value. For instance, the United States uses the U.S. International Trade Commission’s DataWeb, while the European Union provides the TARIC database. These tools account for factors like free trade agreements, preferential tariffs, and additional taxes, providing a comprehensive breakdown of the duties owed. Always verify the information with the latest updates, as duty rates can change due to trade policies or agreements.

In addition to HS codes and customs tools, consider the role of the cheese’s country of origin in duty calculations. Duty rates often vary based on trade agreements between countries. For example, cheese imported from a country with a free trade agreement may qualify for reduced or zero duties. Conversely, cheese from a non-partner country might face higher tariffs. To determine eligibility for preferential rates, check the rules of origin and provide necessary documentation, such as certificates of origin, during the import process. This ensures you benefit from any applicable duty reductions.

Another critical factor in calculating cheese duties is the valuation method used by customs. Duties are typically calculated as a percentage of the cheese’s customs value, which includes the cost of the product, shipping, insurance, and other applicable charges. Some countries may also impose additional fees, such as value-added tax (VAT) or excise duties, on top of the base duty rate. Familiarize yourself with the valuation rules of your country’s customs authority to avoid underpayment or overpayment of duties. Keeping detailed records of all costs associated with the import will facilitate accurate duty calculations.

Finally, leverage technology and professional expertise to streamline the duty calculation process. Customs brokers and trade consultants specialize in navigating complex import regulations and can provide valuable guidance on HS codes, duty rates, and compliance requirements. Additionally, software solutions and apps designed for international trade can automate duty calculations, reducing the risk of errors. By combining these resources with a thorough understanding of HS codes and customs tools, you can confidently determine the exact duty amounts for cheese imports and ensure a smooth customs clearance process.

Perfect Portions: Deli Cheese Per Person for Sandwich Success

You may want to see also

Frequently asked questions

Duties on cheese are calculated based on factors like the type of cheese, its country of origin, and the applicable tariff rates set by the importing country. These rates can be ad valorem (percentage of the product's value) or specific (fixed amount per unit).

The average duty rate for imported cheese in the U.S. varies widely, ranging from 0% to over 20%, depending on the type of cheese and its country of origin. Some cheeses from countries with trade agreements may have reduced or zero tariffs.

Yes, duties on cheese differ significantly between countries due to varying trade policies, agreements, and domestic regulations. For example, the EU may impose higher tariffs on non-member countries compared to those within its trade bloc.

Yes, certain countries have duty-free cheese imports under specific trade agreements or programs. For instance, some cheeses from Canada or Mexico may enter the U.S. duty-free under USMCA (United States-Mexico-Canada Agreement).

You can find the exact duty rate by checking the Harmonized Tariff Schedule (HTS) of the importing country or using online tools like the U.S. International Trade Commission’s Tariff Database. Consulting a customs broker or trade expert is also recommended.