Cold pack cheese, a popular and versatile dairy product, holds a significant presence in the United States, with its consumption and production reflecting the nation's diverse culinary preferences. This type of cheese, known for its creamy texture and mild flavor, is widely used in various dishes, from sandwiches to salads, making it a staple in many American households. The U.S. market for cold pack cheese is substantial, with numerous brands and varieties available, catering to different tastes and dietary needs. Understanding the volume and distribution of cold pack cheese in the U.S. provides valuable insights into consumer trends, regional preferences, and the overall dairy industry's impact on the economy. As such, exploring how much cold pack cheese is available and consumed across the country sheds light on its importance in American food culture and commerce.

Explore related products

What You'll Learn

- Coldpack Cheese Market Size: Total volume and value of coldpack cheese produced and sold in the U.S

- Top Producers: Leading companies manufacturing and distributing coldpack cheese across the United States

- Regional Consumption: Breakdown of coldpack cheese consumption by U.S. states or regions

- Import/Export Data: Volume of coldpack cheese imported into or exported from the U.S. annually

- Consumer Trends: Popular types and brands of coldpack cheese preferred by U.S. consumers

Coldpack Cheese Market Size: Total volume and value of coldpack cheese produced and sold in the U.S

The coldpack cheese market in the U.S. is a niche yet significant segment within the broader dairy industry. Coldpack cheese, known for its unique packaging method that preserves freshness without refrigeration for a limited time, has gained popularity among consumers seeking convenience and portability. To understand the market size, it is essential to analyze both the volume and value of coldpack cheese produced and sold in the U.S. While specific data on coldpack cheese alone is limited, insights can be derived from broader cheese market statistics and industry reports. The U.S. cheese market is substantial, with annual production exceeding 13 billion pounds, and coldpack cheese represents a growing portion of this total, particularly in the snack cheese category.

Estimating the total volume of coldpack cheese produced in the U.S. involves examining trends in snack cheese consumption and packaging innovations. Coldpack cheese is often sold in single-serve portions, making it a popular choice for on-the-go consumers. Industry analysts suggest that snack cheese, including coldpack varieties, accounts for approximately 5-7% of the total cheese market by volume. Given the overall cheese production figures, this translates to roughly 650 million to 910 million pounds of snack cheese annually, with coldpack cheese contributing a notable share. However, precise volume data for coldpack cheese alone remains challenging to pinpoint due to the lack of segmented reporting by major manufacturers.

In terms of market value, coldpack cheese commands a premium due to its convenience and specialized packaging. The U.S. snack cheese market, valued at over $2 billion, reflects strong consumer demand for products like coldpack cheese. Coldpack cheese typically retails at a higher price point compared to traditional cheese, driven by packaging costs and consumer willingness to pay for convenience. While exact figures for coldpack cheese sales are not widely published, it is estimated to represent 10-15% of the snack cheese market by value, equating to approximately $200 million to $300 million annually. This valuation underscores the product’s importance in the dairy sector.

Several factors influence the growth and market size of coldpack cheese in the U.S. Rising consumer demand for convenient, ready-to-eat snacks has been a key driver, particularly among health-conscious and busy individuals. Additionally, innovations in packaging technology have enhanced the shelf life and appeal of coldpack cheese. However, challenges such as competition from other snack categories and fluctuating dairy prices can impact market dynamics. Major players in the industry, including brands like Sargento and Frigo, continue to invest in product development and marketing to capitalize on this growing segment.

In conclusion, while precise data on the total volume and value of coldpack cheese produced and sold in the U.S. is limited, it is clear that this segment plays a meaningful role within the broader cheese and snack food markets. With an estimated volume contribution of several hundred million pounds and a market value ranging from $200 million to $300 million, coldpack cheese represents a dynamic and evolving category. As consumer preferences for convenience and portability continue to shape the food industry, the coldpack cheese market is poised for further growth, supported by ongoing innovation and strategic investments by key industry players.

Goat Milk to Cheese Ratio: How Much Do You Need?

You may want to see also

Top Producers: Leading companies manufacturing and distributing coldpack cheese across the United States

The cold pack cheese market in the United States is a thriving sector, with several key players dominating the production and distribution landscape. These companies have established themselves as top producers, ensuring a steady supply of this popular cheese variety across the country. Here is an overview of some of the leading manufacturers and distributors:

Saputo Inc. is a prominent name in the US dairy industry and a major producer of cold pack cheese. With a strong presence in the market, Saputo offers a wide range of cheese products, including cold pack cheese, through its various brands. The company's extensive distribution network ensures that its products reach consumers nationwide. Saputo's commitment to quality and innovation has solidified its position as a top choice for retailers and consumers alike.

Kraft Heinz is another industry giant and a leading manufacturer of cold pack cheese. Their well-known brands, such as Kraft and Velveeta, are household names in the US. Kraft Heinz's expertise in cheese production and its ability to cater to diverse consumer preferences have made it a dominant force in the market. The company's efficient distribution channels guarantee that their cold pack cheese products are readily available in supermarkets and retail stores across the United States.

Dairy Farmers of America (DFA) is a cooperative owned by dairy farmers, and it plays a significant role in the cold pack cheese market. DFA's focus on sustainable and high-quality dairy products has earned them a reputable position. They supply cold pack cheese to various retailers and foodservice operators, ensuring a consistent supply chain. The cooperative's dedication to supporting local farmers while delivering premium cheese products has contributed to its success.

Leprino Foods is a major player in the cheese industry, specializing in mozzarella and other cheese varieties, including cold pack cheese. They are known for their advanced manufacturing capabilities and have established long-term partnerships with leading pizza and foodservice brands. Leprino's focus on innovation and custom cheese solutions has made them a preferred supplier for many businesses in the food industry.

These top producers have significantly contributed to the availability and popularity of cold pack cheese in the US market. Their manufacturing capabilities, brand recognition, and efficient distribution networks ensure that consumers have access to a wide range of cold pack cheese products. As the demand for convenient and versatile cheese options continues to grow, these companies are well-positioned to meet the needs of the American market.

How Much Does Chuck E. Cheese Cost? A Detailed Breakdown

You may want to see also

Regional Consumption: Breakdown of coldpack cheese consumption by U.S. states or regions

Coldpack cheese, a staple in American households, exhibits varying consumption patterns across different U.S. regions, influenced by cultural preferences, culinary traditions, and demographic factors. The Midwest, often referred to as "America's Dairyland," leads in coldpack cheese consumption. States like Wisconsin, Minnesota, and Illinois dominate this category due to their strong dairy industries and a population that favors cheese as a dietary staple. Wisconsin, in particular, is renowned for its cheese production and consumption, with residents enjoying coldpack varieties in dishes like cheese curds, sandwiches, and cheese boards. The region's colder climate also encourages the consumption of hearty, cheese-based meals, further boosting demand.

In the Northeast, coldpack cheese consumption is notably high in states such as New York, Pennsylvania, and Massachusetts. This region's culinary traditions, including the popularity of cheesesteaks, pizza, and charcuterie boards, drive significant cheese usage. New York City, with its diverse population and thriving food scene, contributes substantially to the region's overall consumption. Additionally, Pennsylvania's strong dairy heritage, exemplified by brands like Cabot Creamery, reinforces the preference for coldpack cheese in this area. Urban centers in the Northeast also tend to have higher disposable incomes, allowing for greater expenditure on premium cheese products.

The South, while traditionally associated with comfort foods like fried chicken and barbecue, has seen a steady rise in coldpack cheese consumption, particularly in states like Texas and Florida. Texas, with its large population and diverse culinary influences, incorporates cheese into Tex-Mex dishes like queso and nachos, as well as traditional American fare. Florida's consumption is driven by its tourism industry and a population that enjoys cheese in snacks, sandwiches, and appetizers. However, overall consumption in the South remains lower compared to the Midwest and Northeast, reflecting differing dietary preferences and culinary traditions.

The West Coast, including California, Oregon, and Washington, showcases a unique coldpack cheese consumption profile shaped by health-conscious trends and innovative culinary practices. California, as the nation's most populous state and a hub for food innovation, contributes significantly to coldpack cheese demand, particularly in artisanal and specialty varieties. The region's emphasis on fresh, locally sourced ingredients has led to the incorporation of coldpack cheese in gourmet dishes and snack products. Oregon and Washington, with their thriving dairy industries and farm-to-table movements, also exhibit strong consumption, though at a smaller scale compared to California.

Lastly, the Mountain and Plains states, such as Colorado, Utah, and Montana, have moderate coldpack cheese consumption levels. These regions, characterized by smaller populations and a mix of urban and rural lifestyles, incorporate cheese into everyday meals but lack the concentrated demand seen in more densely populated areas. However, the growing popularity of outdoor activities and gatherings in these states has increased the use of coldpack cheese in portable, convenient formats like cheese sticks and snack packs. Overall, regional consumption patterns highlight the diverse ways Americans enjoy coldpack cheese, shaped by local traditions, demographics, and economic factors.

Vegan Cheese Fat Content: Uncovering the Truth Behind Plant-Based Options

You may want to see also

Explore related products

Import/Export Data: Volume of coldpack cheese imported into or exported from the U.S. annually

The volume of cold pack cheese imported into or exported from the United States annually is a critical aspect of understanding the domestic supply and demand dynamics of this specific dairy product. Cold pack cheese, which includes varieties like cheddar, Swiss, and mozzarella, is a significant segment of the U.S. cheese market. According to data from the United States Department of Agriculture (USDA) and the International Trade Commission (ITC), the U.S. is both a major producer and consumer of cheese, but it also engages in substantial import and export activities to balance market needs. Annually, the U.S. imports approximately 300,000 to 400,000 metric tons of cheese, with cold pack cheese constituting a notable portion of this volume. These imports primarily come from countries like Italy, France, and the Netherlands, which are renowned for their specialty cheeses.

On the export side, the U.S. ships out around 200,000 to 300,000 metric tons of cheese annually, with cold pack cheese being a significant export category. Key export destinations include Mexico, Canada, and countries in East Asia, where demand for American-made cheese has been steadily growing. The export volume is influenced by factors such as global dairy prices, trade agreements, and consumer preferences in international markets. For instance, the United States-Mexico-Canada Agreement (USMCA) has facilitated smoother trade of dairy products, including cold pack cheese, between the U.S. and its North American neighbors.

Import data reveals that the U.S. relies on imports to diversify its cheese offerings, particularly for specialty cold pack cheeses that are traditionally produced in Europe. These imports often cater to niche markets, such as gourmet food retailers and high-end restaurants. The USDA’s Foreign Agricultural Service (FAS) reports that imported cold pack cheese accounts for about 5-7% of the total cheese consumed in the U.S., highlighting its role in complementing domestic production. However, tariffs and import quotas, as outlined in trade agreements, can impact the volume and cost of these imports.

Export data underscores the U.S.’s position as a competitive player in the global cheese market. American cold pack cheese exports are favored for their quality, consistency, and competitive pricing. The growth in exports is partly driven by increasing global demand for protein-rich foods and the expanding middle class in emerging markets. However, exporters face challenges such as fluctuating dairy prices, logistical constraints, and competition from other cheese-producing nations. The ITC’s trade data shows that while exports have been on an upward trend, they still lag behind imports, indicating a net import position for the U.S. in the cold pack cheese category.

Analyzing the import/export data also reveals seasonal fluctuations in the volume of cold pack cheese traded. For instance, imports tend to peak during the holiday season when demand for specialty cheeses rises, while exports may increase during periods of surplus domestic production. Additionally, geopolitical events, such as trade disputes or changes in tariffs, can significantly impact annual trade volumes. Stakeholders, including dairy farmers, processors, and distributors, closely monitor these trends to make informed decisions about production, pricing, and market strategies.

In conclusion, the annual import and export volumes of cold pack cheese in the U.S. reflect the country’s integrated role in the global dairy market. While imports enrich the domestic cheese landscape with specialty products, exports showcase the competitiveness of American cheese producers. Understanding these trade dynamics is essential for assessing the availability of cold pack cheese in the U.S. and its contribution to the broader dairy industry. Continued monitoring of import/export data will remain crucial for stakeholders navigating this evolving market.

String Cheese Fiber Content: Unwrapping the Nutritional Facts

You may want to see also

Consumer Trends: Popular types and brands of coldpack cheese preferred by U.S. consumers

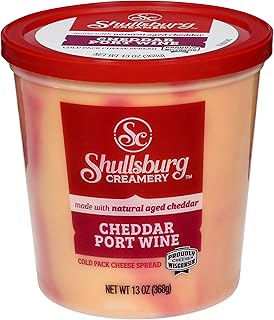

The U.S. cold pack cheese market is a dynamic and growing segment within the broader dairy industry, with consumers increasingly seeking convenient, high-quality cheese options. Cold pack cheese, typically sold in sealed packages without refrigeration until opened, has gained popularity due to its convenience, portability, and extended shelf life. According to industry reports, the U.S. market for cold pack cheese has seen steady growth, driven by consumer demand for on-the-go snacks and meal solutions. Popular types of cold pack cheese include cheddar, pepper jack, Colby, and mozzarella, which are often sold in individually wrapped portions or larger resealable packs.

Among the most preferred brands of cold pack cheese in the U.S., Sargento stands out as a market leader. Known for its Balanced Breaks and Snack Bites, Sargento offers a variety of cheese types paired with nuts, dried fruits, or meats, catering to health-conscious consumers. Another prominent brand is Frigo Cheese Heads, famous for its string cheese, which appeals to both children and adults as a convenient snack option. Kraft Heinz also holds a significant share with its individually wrapped cheddar and mozzarella sticks, often found in lunchboxes and vending machines. These brands have capitalized on consumer trends by offering portion-controlled, ready-to-eat products that align with busy lifestyles.

Consumer preferences for cold pack cheese are heavily influenced by flavor innovation and health considerations. Spicy varieties, such as jalapeño or habanero-infused cheeses, have gained traction among younger demographics seeking bold flavors. Similarly, low-fat and reduced-sodium options cater to health-conscious consumers, while organic and grass-fed cold pack cheeses are becoming more popular in niche markets. The rise of plant-based diets has also led to the introduction of vegan cold pack cheese alternatives, though traditional dairy-based products still dominate the market.

Packaging plays a critical role in consumer choice, with brands investing in resealable, eco-friendly, and visually appealing designs. Single-serve packs are particularly popular for their convenience, while larger family-sized packs appeal to cost-conscious shoppers. Additionally, transparent labeling highlighting natural ingredients, no preservatives, and sustainability practices resonates with environmentally aware consumers. Retailers have responded by expanding cold pack cheese offerings in both traditional grocery stores and online platforms, making these products more accessible than ever.

Regional preferences also shape the cold pack cheese market in the U.S. For instance, cheddar dominates in the Midwest, reflecting the region's dairy heritage, while pepper jack and Monterey Jack are more popular in the Southwest due to their use in Mexican cuisine. Brands often tailor their product lines to regional tastes, further driving consumer engagement. As the market continues to evolve, understanding these trends will be crucial for manufacturers and retailers aiming to meet the diverse needs of U.S. consumers.

Wisconsin Cheese Soup Fiber Content: A Nutritional Breakdown

You may want to see also

Frequently asked questions

The exact amount of cold pack cheese produced annually in the US is not publicly disclosed, but it is part of the broader cheese production, which totaled approximately 13.7 billion pounds in 2022, according to the USDA.

Cold pack cheese represents a small but growing segment of the US cheese market, estimated to be less than 5% of total cheese production, as it is a niche product primarily used in food service and industrial applications.

Wisconsin, California, and Idaho are among the top cheese-producing states in the US, but specific data on cold pack cheese production by state is limited, as it is often grouped with other cheese types in industry reports.

Export data for cold pack cheese specifically is not readily available, as it is often categorized under broader cheese export statistics. In 2022, the US exported over 400,000 metric tons of cheese, but the share of cold pack cheese is not separately reported.