The question of whether all Parmesan cheese consumed in the United States is imported is a common one, reflecting the cheese's Italian origins and its global popularity. While authentic Parmigiano-Reggiano, the traditional Italian hard cheese, is indeed imported from specific regions in Italy, the term Parmesan in the U.S. is often used more broadly to describe similar cheeses produced domestically. This distinction highlights the complexities of food labeling and the interplay between tradition, regulation, and consumer expectations in the American market.

| Characteristics | Values |

|---|---|

| Is all Parmesan cheese imported in the US? | No |

| Percentage of Parmesan cheese imported | Approximately 20-30% (varies by year and source) |

| Primary import sources | Italy (especially Parmigiano-Reggiano), other European countries |

| Domestic Parmesan production | Yes, significant production in the US, particularly in Wisconsin and California |

| Labeling requirements for imported Parmesan | Must meet specific standards (e.g., Parmigiano-Reggiano PDO for Italian imports) |

| Labeling requirements for domestic Parmesan | Must adhere to FDA standards but does not require PDO certification |

| Common domestic brands | BelGioioso, Sartori, Rumiano Cheese |

| Price comparison | Imported Parmesan (especially Parmigiano-Reggiano) is generally more expensive than domestic varieties |

| Taste and texture differences | Imported Parmesan often considered more complex and nutty; domestic varieties may vary in flavor profile |

| Availability | Both imported and domestic Parmesan widely available in US grocery stores and specialty shops |

| Regulatory oversight | Imported cheese must meet USDA and FDA standards; domestic cheese regulated by the FDA |

Explore related products

What You'll Learn

- US Parmesan Production: Domestic production vs. import reliance for Parmesan cheese in the United States

- Import Regulations: FDA and USDA rules governing imported Parmesan cheese in the U.S. market

- Authentic Italian Parmesan: Requirements for importing true Parmigiano-Reggiano from Italy to the U.S

- Domestic Alternatives: U.S.-made Parmesan substitutes and their market share compared to imports

- Trade Statistics: Data on Parmesan cheese imports vs. domestic production volumes in the U.S

US Parmesan Production: Domestic production vs. import reliance for Parmesan cheese in the United States

Not all Parmesan cheese consumed in the United States is imported. While authentic Parmigiano-Reggiano, a protected designation of origin (PDO) product, hails exclusively from specific regions in Italy, the US market also includes domestically produced Parmesan-style cheeses. These American versions, though not labeled as Parmigiano-Reggiano, meet the demand for hard, granular cheeses used in similar culinary applications. This duality in sourcing raises questions about the scale of domestic production versus import reliance and its implications for consumers and the dairy industry.

Domestic Parmesan production in the US has grown significantly over the past few decades, driven by consumer demand and advancements in cheesemaking technology. States like Wisconsin, California, and New York have emerged as key producers, with facilities capable of replicating the aging and texture characteristics of traditional Parmesan. For instance, some American producers age their cheeses for 10 to 12 months, approaching the 12-month minimum required for Parmigiano-Reggiano. However, domestic output still falls short of meeting total US demand, necessitating imports to fill the gap.

Imported Parmesan, primarily from Italy, dominates the premium segment of the market. Authentic Parmigiano-Reggiano is highly regulated, with strict guidelines on milk source, production methods, and aging. This ensures a consistent, superior product that commands a premium price. In 2022, the US imported over 40 million pounds of Italian hard cheeses, including Parmigiano-Reggiano, valued at approximately $350 million. This reliance on imports highlights the challenges domestic producers face in competing with the heritage and brand recognition of Italian PDO cheeses.

For consumers, the choice between domestic and imported Parmesan often comes down to price, availability, and authenticity. Domestic Parmesan-style cheeses are generally more affordable and widely available in supermarkets, making them a practical option for everyday cooking. In contrast, imported Parmigiano-Reggiano is typically reserved for special dishes or discerning palates, with prices ranging from $20 to $40 per pound. To navigate this, consumers can look for PDO labels on imported cheeses and compare aging times on domestic products to gauge quality.

The balance between domestic production and import reliance for Parmesan in the US reflects broader trends in the global food market. While domestic producers innovate to meet demand, imported cheeses maintain a stronghold due to their cultural and historical significance. This dynamic ensures a diverse market, offering options for both budget-conscious shoppers and gourmet enthusiasts. As the US dairy industry continues to evolve, the interplay between local innovation and international tradition will shape the future of Parmesan consumption in the country.

Eggs and Cheese: Uncovering Surprising Nutritional Similarities and Differences

You may want to see also

Import Regulations: FDA and USDA rules governing imported Parmesan cheese in the U.S. market

Not all Parmesan cheese consumed in the U.S. is imported; domestic producers like BelGioioso and Sartori craft versions labeled as "Parmesan" under FDA standards. However, true Parmigiano-Reggiano, protected by EU law, must be imported from specific regions in Italy. This distinction highlights the regulatory maze importers navigate, where FDA and USDA rules dictate everything from labeling to safety.

The FDA mandates that imported Parmesan meet the Standard of Identity for pasteurized cheese, requiring minimum milkfat (32%) and moisture (32-34%) levels. Inspectors verify these through documentation and sampling at ports of entry, rejecting shipments that fall short. For instance, a 2019 FDA detention report flagged a Parmigiano-Reggiano consignment for inadequate pasteurization records, illustrating the agency’s zero-tolerance policy on safety.

USDA involvement is subtler but critical. While the FDA handles safety, the USDA’s Agricultural Marketing Service (AMS) enforces labeling accuracy under the U.S. Dairy Export Council guidelines. Imported Parmigiano-Reggiano must display its PDO (Protected Designation of Origin) seal, a detail often overlooked by retailers. A 2021 AMS audit revealed 15% of imported Parmesan in U.S. markets lacked proper PDO labeling, risking consumer confusion and legal penalties.

Importers face additional hurdles with customs tariffs and phytosanitary certificates. Parmesan enters under Harmonized Tariff Schedule code 0406.90.2060, with a 4% duty rate. However, the 2019 U.S.-Italy trade tensions temporarily hiked this to 25%, slashing imports by 12% that year. Such volatility underscores the need for importers to monitor trade agreements and maintain flexible supply chains.

To comply, importers should: (1) ensure suppliers provide FDA-compliant pasteurization records; (2) verify PDO labeling for Parmigiano-Reggiano; (3) pre-clear shipments through FDA’s Prior Notice system (minimum 2 hours before arrival); and (4) budget for tariff fluctuations. Ignoring these steps risks detention, destruction, or fines up to $50,000 per violation. In a market where authenticity sells, adherence to FDA and USDA rules isn’t optional—it’s the cost of entry.

Masterbuilt Slow Smoker Guide: Perfectly Smoking Cheese at Home

You may want to see also

Authentic Italian Parmesan: Requirements for importing true Parmigiano-Reggiano from Italy to the U.S

Not all Parmesan cheese in the U.S. is imported, but true Parmigiano-Reggiano must come from Italy to bear that name. This iconic cheese, protected by European Union law, can only be produced in specific regions of Italy: Parma, Reggio Emilia, Modena, Mantua, and Bologna. To import authentic Parmigiano-Reggiano into the U.S., strict requirements must be met, ensuring consumers receive the real deal.

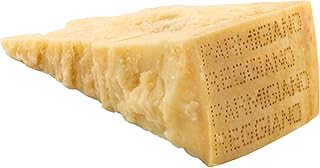

Production Standards: The process begins with raw cow’s milk from cows fed a controlled diet of fresh grass, hay, and specific grains. The milk is partially skimmed naturally and mixed with whey starter, rennet, and salt. After curdling, the cheese is molded, brined, and aged for a minimum of 12 months, though 24–36 months is common. Inspectors from the Parmigiano-Reggiano Consortium monitor every step, ensuring adherence to centuries-old traditions. Only cheeses meeting these standards are fire-branded with the iconic dotted pattern, certifying their authenticity.

Import Regulations: U.S. importers must comply with FDA and USDA guidelines, which include proper labeling, health certifications, and proof of origin. The cheese must be accompanied by a Certificate of Authenticity from the Consortium, verifying its production region and methods. Additionally, importers must ensure the cheese is stored and transported under controlled conditions to preserve its quality. Failure to meet these requirements can result in seizure or refusal of entry by U.S. customs.

Practical Tips for Consumers: To ensure you’re buying genuine Parmigiano-Reggiano, look for the stamped rind, the Consortium’s seal, and the words “Parmigiano-Reggiano” on the label. Avoid products labeled simply as “Parmesan,” which can be domestically produced imitations. Authentic Parmigiano-Reggiano has a granular texture, complex nutty flavor, and a price point reflecting its craftsmanship. Store it in a cool, dry place, wrapped in wax paper or parchment, and use a microplane grater to maximize its flavor.

Economic and Cultural Impact: Importing Parmigiano-Reggiano supports Italian dairy farmers and artisans while offering U.S. consumers a taste of Italy’s culinary heritage. However, the high cost of production and import tariffs make it a premium product. For those seeking authenticity, the investment is worth it—Parmigiano-Reggiano is not just a cheese but a testament to tradition, quality, and craftsmanship.

Jalapeno Cheese Bread Storage: Refrigerate or Room Temp?

You may want to see also

Explore related products

Domestic Alternatives: U.S.-made Parmesan substitutes and their market share compared to imports

Not all Parmesan cheese consumed in the U.S. is imported, despite its Italian origins. Domestic producers have stepped into the market with alternatives that mimic the flavor, texture, and versatility of traditional Parmigiano-Reggiano. These U.S.-made substitutes, often labeled as "Parmesan" or "hard grating cheese," are crafted to meet the demand for affordable, locally sourced options. While they may not carry the Protected Designation of Origin (PDO) status of their Italian counterparts, they have carved out a significant niche in the American dairy market.

One prominent domestic alternative is BelGioioso’s Parmesan, produced in Wisconsin, a state renowned for its dairy industry. This cheese is aged for a minimum of 10 months, offering a sharp, nutty flavor profile that rivals imported varieties. Another notable example is Sartori’s SarVecchio Parmesan, also Wisconsin-made, which is aged for up to 20 months for a more complex taste. These products are widely available in supermarkets and specialty stores, often at a lower price point than imported Parmigiano-Reggiano, making them accessible to budget-conscious consumers.

Market share data reveals that while imported Parmesan still dominates the premium segment, domestic alternatives have steadily gained ground. According to the USDA, U.S.-produced hard grating cheeses account for approximately 30% of the total Parmesan market. This growth is driven by factors such as consumer preference for locally sourced products, reduced shipping costs, and the ability of domestic producers to scale production efficiently. However, imported Parmesan retains a loyal following among purists who value its authenticity and traditional production methods.

For home cooks and chefs seeking domestic substitutes, it’s essential to consider the intended use. U.S.-made Parmesan works well in recipes requiring grated cheese, such as pasta dishes or salads, where the difference in flavor is less pronounced. However, for applications like a standalone cheese board or risotto, where the cheese’s quality is more noticeable, imported Parmigiano-Reggiano may be the better choice. Pairing domestic Parmesan with bold flavors, such as garlic or red pepper flakes, can also enhance its profile in dishes.

In conclusion, while imported Parmesan remains a staple in the U.S. market, domestic alternatives offer a practical and cost-effective solution for everyday cooking. By understanding the nuances between these options, consumers can make informed choices that balance taste, budget, and culinary needs. As the domestic cheese industry continues to innovate, the gap between imported and U.S.-made Parmesan is likely to narrow further, providing even more options for cheese enthusiasts.

Are Taco Bell's Nacho Cheese Chalupas Still on the Menu?

You may want to see also

Trade Statistics: Data on Parmesan cheese imports vs. domestic production volumes in the U.S

Not all Parmesan cheese consumed in the U.S. is imported, despite its Italian origins. Trade statistics reveal a nuanced interplay between imports and domestic production. According to the USDA, the U.S. imported approximately 40 million pounds of Parmesan cheese in 2022, primarily from Italy, which remains the gold standard for authenticity. However, domestic production has been steadily rising, with U.S. manufacturers producing around 30 million pounds annually to meet growing demand. This balance reflects consumer preferences for both traditional imported varieties and locally produced alternatives, often marketed as "Parmesan-style" due to EU regulations restricting the "Parmigiano-Reggiano" label to cheese produced in specific Italian regions.

Analyzing the data, the import-to-production ratio highlights Italy’s dominance in the Parmesan market, accounting for over 90% of U.S. imports. Yet, domestic producers are carving out a niche by emphasizing cost-effectiveness, shorter supply chains, and compliance with U.S. labeling laws. For instance, Wisconsin and California lead U.S. Parmesan production, leveraging advanced aging techniques to replicate the texture and flavor of Italian varieties. While imported Parmesan commands a premium, domestic versions often target price-sensitive consumers or foodservice industries, where bulk usage is common.

From a practical standpoint, understanding these trade statistics can guide purchasing decisions. For home cooks seeking authentic Parmigiano-Reggiano, imported varieties are the only option, identifiable by the dotted "Parmigiano-Reggiano" stamp on the rind. Domestic Parmesan, while not meeting EU standards, offers a viable alternative for everyday use, such as grating over pasta or incorporating into recipes where subtler flavor differences are less noticeable. Retailers can also leverage this data to optimize inventory, balancing premium imported stocks with more affordable domestic options.

A comparative analysis of trade trends shows that while imports have remained relatively stable over the past decade, domestic production has grown by approximately 15% since 2018. This shift is partly driven by consumer interest in locally sourced products and tariffs on European imports. However, challenges persist for U.S. producers, including the higher cost of milk and the time-intensive aging process required for Parmesan. Despite these hurdles, the coexistence of imported and domestic Parmesan reflects a dynamic market responsive to both tradition and innovation.

In conclusion, trade statistics debunk the myth that all Parmesan cheese in the U.S. is imported. While Italy’s Parmigiano-Reggiano remains unparalleled, domestic production plays a significant role in meeting demand. By examining import volumes and domestic output, consumers and businesses can make informed choices, balancing authenticity with practicality in the Parmesan market.

Quarter Pounder with Cheese: The Real Name Behind the Burger

You may want to see also

Frequently asked questions

No, not all Parmesan cheese in the US is imported. While authentic Parmigiano-Reggiano is imported from Italy, many domestic producers in the US make Parmesan-style cheeses.

Imported Parmigiano-Reggiano is strictly regulated and produced in specific regions of Italy, following traditional methods. Domestic Parmesan in the US may use similar techniques but is not subject to the same regulations and often has variations in flavor and texture.

No, only cheese produced in designated regions of Italy (Parma, Reggio Emilia, Modena, Bologna, and Mantua) can be labeled as Parmigiano-Reggiano. Domestic Parmesan must be labeled as such to avoid confusion.

Check the label for the words "Parmigiano-Reggiano" and a DOP (Protected Designation of Origin) seal for imported cheese. Domestic Parmesan will typically be labeled as "Parmesan" or "Parmesan Cheese" without the DOP designation.