Brexit, the United Kingdom's withdrawal from the European Union, has sparked countless debates, economic analyses, and cultural shifts, but its comparison to cheese might seem unconventional at first glance. However, the analogy gains traction when considering the complex, multifaceted, and often divisive nature of both Brexit and cheese. Just as Brexit has polarized opinions, cheese evokes strong reactions—some revel in its rich flavors, while others find it overpowering or even intolerable. Both Brexit and cheese have deep historical roots, yet their modern implications are far from settled. Whether Brexit is the new cheese remains a matter of perspective, but the comparison highlights how seemingly disparate topics can intersect in surprising ways, reflecting broader themes of identity, tradition, and change.

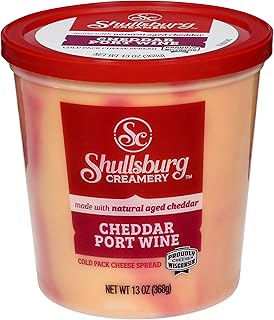

Explore related products

What You'll Learn

- Economic Impact: Trade deals, tariffs, and the effect on UK-EU cheese markets post-Brexit

- Regulatory Changes: New standards for cheese production, labeling, and export compliance

- Supply Chain Disruptions: Delays, costs, and challenges in cheese distribution across borders

- Cultural Shifts: How Brexit influences cheese preferences and consumption trends in the UK

- Political Cheese Wars: Diplomatic tensions and negotiations over protected cheese names (e.g., Stilton)

Economic Impact: Trade deals, tariffs, and the effect on UK-EU cheese markets post-Brexit

Post-Brexit trade deals have reshaped the UK-EU cheese market, introducing tariffs and regulatory barriers that disrupt decades-old supply chains. Before Brexit, the UK exported £120 million worth of cheese to the EU annually, duty-free. Now, under the UK-EU Trade and Cooperation Agreement (TCA), cheese exports face tariffs of up to 50% if they exceed agreed quotas. For instance, cheddar, the UK’s flagship export, is subject to a 25% tariff if shipments surpass 15,000 tonnes per year. This has forced UK producers to absorb costs or pass them to consumers, making British cheese less competitive in EU markets.

The impact on EU cheese imports to the UK is equally significant, though in a different direction. The UK is the EU’s largest cheese export market, importing €400 million worth annually pre-Brexit. Post-Brexit, EU cheeses like French brie and Italian parmesan face UK tariffs of up to 35% if not covered by the TCA’s limited quota-free access. Retailers have responded by raising prices, with some EU cheeses costing 10-15% more in UK supermarkets. This has shifted consumer behavior, with a 7% increase in sales of UK-produced cheese alternatives in 2023, according to Kantar data.

Small and medium-sized cheese producers on both sides have been hit hardest. Unlike multinationals, they lack the resources to navigate complex customs procedures or absorb tariff costs. For example, a Somerset-based cheddar producer reported a 30% drop in EU sales post-Brexit due to tariffs and delays. Similarly, a French artisanal cheese maker saw UK orders halve after retailers switched to cheaper domestic alternatives. These disruptions highlight the fragility of niche markets in the face of trade barriers.

To mitigate these effects, UK producers are exploring new markets, such as the US and Asia, though these require significant investment in marketing and compliance with foreign standards. The UK government’s recent trade deals with Australia and New Zealand offer tariff-free access for cheese but are unlikely to offset EU losses, as these markets are smaller and less established. Meanwhile, EU producers are focusing on intra-EU trade and diversifying into growing markets like China. For consumers, the takeaway is clear: Brexit has permanently altered the cheese landscape, favoring larger producers and domestic options while reducing variety and increasing costs.

The Timeless Journey of Aged Cheese: Origins and Evolution

You may want to see also

Regulatory Changes: New standards for cheese production, labeling, and export compliance

Brexit has reshaped the regulatory landscape for the UK’s cheese industry, introducing new standards that producers, exporters, and consumers must navigate. One of the most significant changes lies in production standards. Post-Brexit, the UK is no longer bound by EU regulations, allowing for the development of its own guidelines. For instance, the use of raw milk in cheese production, which was heavily regulated under EU law, now falls under UK-specific rules. Producers must adhere to new hygiene and safety protocols, such as increased testing for pathogens like E. coli and Listeria. This shift offers both opportunities for innovation and challenges in ensuring compliance with evolving standards.

Labeling requirements have also undergone a transformation, demanding meticulous attention from manufacturers. The UK’s new rules mandate clearer allergen declarations, origin labeling, and nutritional information. For example, cheeses exported to the EU must now include EU-specific health and safety certifications, while those sold domestically must comply with UK Food Standards Agency guidelines. This dual compliance can be complex, particularly for small-scale producers. Practical tips include investing in customizable labeling software and consulting with regulatory experts to avoid costly recalls or export delays.

Export compliance has emerged as a critical area of focus, with Brexit introducing tariffs, customs checks, and additional documentation for cheese exports to the EU. Exporters must now complete Export Health Certificates (EHCs) for each consignment, a process that can take up to 48 hours. To streamline this, businesses should consider partnering with certified EHC issuers and leveraging digital platforms for real-time updates on regulatory changes. Additionally, understanding the EU’s rules of origin criteria is essential to qualify for preferential tariffs under the UK-EU Trade and Cooperation Agreement.

The cumulative effect of these regulatory changes is a redefinition of the UK cheese industry’s competitive landscape. While larger producers may have the resources to adapt quickly, smaller businesses face disproportionate challenges. To thrive, companies must prioritize training, invest in technology, and foster strong relationships with regulatory bodies. For consumers, these changes may translate to higher prices but also greater transparency and safety. Ultimately, Brexit’s regulatory overhaul is not just about compliance—it’s about reshaping the identity and future of British cheese.

Cheesecake Battles: Why Do We Clash Over This Dessert?

You may want to see also

Supply Chain Disruptions: Delays, costs, and challenges in cheese distribution across borders

Brexit has introduced a labyrinth of regulatory hurdles that significantly disrupt the once-seamless flow of cheese across borders. Prior to 2020, a wheel of Cheddar from Somerset could reach a Parisian fromagerie in 24 hours. Post-Brexit, the same journey now requires a customs declaration, sanitary and phytosanitary (SPS) checks, and compliance with EU rules of origin. For instance, a single consignment of artisanal Blue Stilton now faces up to 48 hours of inspection delays at Dover, spoiling its delicate aging process and inflating costs by 15-20%. These bureaucratic bottlenecks are not mere inconveniences—they threaten the viability of small-scale producers who rely on just-in-time delivery to maintain product quality.

Consider the financial toll of these disruptions. A case study of a Cheshire-based dairy reveals that post-Brexit tariffs and administrative fees have added £2,500 to the monthly export bill for shipments to Germany. Compounding this, the requirement for Export Health Certificates (EHCs), costing £100 per consignment, has become a non-negotiable expense. For perishable goods like cheese, time is money. A 36-hour delay in transit can reduce the shelf life of soft cheeses like Brie by 20%, forcing retailers to slash prices or incur write-offs. Such losses disproportionately affect UK exporters, who now compete with EU producers unencumbered by these barriers.

To navigate this new reality, businesses must adopt strategic mitigation measures. First, invest in cold chain logistics with real-time tracking to minimize spoilage during delays. Second, explore alternative markets outside the EU, such as the US or Asia, where demand for British cheese is growing. Third, collaborate with EU-based distributors to establish "hub-and-spoke" models, reducing direct cross-border shipments. For example, a Gloucestershire cheese maker partnered with a Dutch logistics firm, cutting transit times by 40% and reducing compliance costs by leveraging the firm’s existing EU certifications.

Yet, even these solutions come with caveats. Diversifying markets requires substantial upfront investment in marketing and compliance with foreign regulations. Relying on intermediaries erodes profit margins, as distributors charge premiums for navigating EU bureaucracy. Moreover, the unpredictability of Brexit-related policies—such as the ongoing dispute over the Northern Ireland Protocol—adds a layer of risk that no amount of planning can fully eliminate. For the cheese industry, Brexit is not just a logistical headache; it’s a structural shift demanding innovation, resilience, and a willingness to rethink traditional supply chains.

Is Cheese String Real Cheese? Unraveling the Dairy Mystery

You may want to see also

Explore related products

Cultural Shifts: How Brexit influences cheese preferences and consumption trends in the UK

Brexit has reshaped the UK’s cheese landscape, not just through trade deals and tariffs, but by altering cultural attitudes toward this ancient food. Before 2016, British consumers often favored continental European cheeses like Brie and Camembert, viewing them as symbols of sophistication. Post-Brexit, however, there’s been a noticeable pivot toward homegrown varieties such as Cheddar, Stilton, and Red Leicester. This shift isn’t merely patriotic—it’s practical. Import disruptions and increased costs have made local cheeses more accessible and affordable, while campaigns like “Back British Farming” have amplified their appeal. The result? A 15% rise in domestic cheese sales between 2019 and 2023, according to Dairy UK.

Consider the rise of artisanal cheesemakers, who have capitalized on this trend by offering unique, locally sourced products. For instance, the number of small-scale creameries in the UK increased by 20% in the past five years, with many experimenting with traditional recipes and innovative flavors. Take the example of Fen Farm Dairy’s Baron Bigod, a raw milk Brie-style cheese that has gained international acclaim. Such successes highlight how Brexit has inadvertently fostered a renaissance in British cheesemaking, turning necessity into opportunity.

Yet, this cultural shift isn’t without its complexities. While some consumers embrace local cheeses, others lament the loss of variety on supermarket shelves. A 2022 survey by YouGov revealed that 38% of UK shoppers missed the ease of accessing European cheeses, particularly those from France and Italy. This tension between nostalgia and nationalism underscores the broader impact of Brexit on culinary identity. To navigate this, retailers are increasingly offering “hybrid” solutions, such as pairing British cheeses with European-inspired recipes or hosting tasting events to educate consumers about local alternatives.

For those looking to adapt their cheese habits in this new era, practical steps can make the transition smoother. Start by exploring regional cheese markets or subscribing to local cheese boxes, which often include tasting notes and pairing suggestions. For instance, a monthly subscription to The Cheese Explorer introduces subscribers to lesser-known British varieties like Yorkshire Blue or Cornish Yarg. Additionally, consider experimenting with British cheeses in classic European dishes—Stilton in a quiche or Red Leicester in a fondue—to bridge the gap between old and new preferences.

Ultimately, Brexit’s influence on cheese consumption reflects a broader cultural recalibration in the UK. It’s not just about what’s on the plate, but what it represents: a blend of tradition, innovation, and resilience. As the nation continues to navigate its post-EU identity, cheese serves as both a metaphor and a medium for this evolving narrative. Whether you’re a purist or a pragmatist, one thing is clear—the UK’s cheese board will never look the same again.

Does Lucky's Sell Cheese Curds? A Shopper's Guide to Availability

You may want to see also

Political Cheese Wars: Diplomatic tensions and negotiations over protected cheese names (e.g., Stilton)

Brexit has unraveled a tangled web of trade disputes, but few are as pungent as the battle over protected cheese names. At the heart of this culinary cold war lies the question: who owns the right to call a cheese "Stilton" or "Feta"? The EU’s Protected Designation of Origin (PDO) system safeguards regional specialties, ensuring that only Stilton produced in Derbyshire, Leicestershire, and Nottinghamshire can bear the name. Post-Brexit, the UK has mirrored this system with its own Geographical Indication (GI) scheme, but the lack of mutual recognition has left producers on both sides of the Channel in a state of ferment.

Consider the plight of British Stilton makers, who now face an identity crisis in EU markets. Without PDO recognition, their cheese risks being rebranded as "white cheese with blue veins," a bland label that strips it of its heritage. Conversely, EU producers worry that UK-made imitations could flood global markets, diluting the prestige of their own PDO cheeses. This isn’t mere pedantry—it’s a battle over economic survival. Stilton exports to the EU alone were valued at £1.2 million in 2020, a sum that could curdle if protections aren’t reinstated.

Diplomatic negotiations have been as hard as aged cheddar. The UK argues for flexibility, suggesting that its GI system is equally rigorous. The EU counters that decades of PDO branding cannot be replicated overnight. A potential compromise? Bilateral agreements that recognize specific cheeses, but progress has been slower than a wheel of Parmigiano-Reggiano aging in a cave. Meanwhile, trade deals with non-EU countries like Japan have prioritized other sectors, leaving cheese producers feeling like the forgotten rind.

For consumers, the stakes are simpler but no less significant. A post-Brexit world could see supermarket shelves filled with "Greek-style cheese" or "English-type blue cheese," confusing shoppers and eroding trust in labels. To navigate this, buyers should look for GI or PDO logos, which remain valid in the UK for now. However, as negotiations drag on, even these certifications may become as ambiguous as a poorly labeled Brie.

The takeaway? Political cheese wars are no laughing matter. They highlight the intricate interplay between culture, economics, and identity in trade agreements. As Brexit continues to mature, the fate of protected cheese names will serve as a litmus test for the UK’s ability to carve out its place in the global market—one wedge at a time.

Mastering the Perfect Bacon Egg and Cheese Order: A Step-by-Step Guide

You may want to see also

Frequently asked questions

No, Brexit is not a type of cheese. Brexit refers to the United Kingdom's withdrawal from the European Union, while cheese is a dairy product. The phrase "Brexit is the new cheese" is likely a humorous or metaphorical expression rather than a literal comparison.

The phrase might be used to highlight the divisive, complex, or ubiquitous nature of Brexit in British discourse, similar to how cheese is a common and sometimes polarizing food. It could also be a playful way to comment on the endless debates and discussions surrounding Brexit.

While there are no officially recognized cheeses named "Brexit," some artisanal cheesemakers or satirists might have created novelty cheeses with Brexit-themed names as a commentary or joke. However, these would be rare and not widely available.