The cheese industry is currently experiencing a dynamic shift driven by evolving consumer preferences, technological advancements, and global market trends. As health-conscious consumers increasingly seek out plant-based, low-fat, and artisanal options, traditional producers are innovating to meet these demands while maintaining the authenticity of their products. Additionally, sustainability has become a focal point, with companies adopting eco-friendly practices in production and packaging to reduce their environmental footprint. Meanwhile, the rise of e-commerce and direct-to-consumer models is reshaping distribution channels, making specialty cheeses more accessible worldwide. However, challenges such as supply chain disruptions, fluctuating dairy prices, and regulatory changes continue to impact the industry, forcing stakeholders to adapt swiftly to stay competitive in this ever-changing landscape.

Explore related products

$39.92 $23.27

What You'll Learn

- Sustainability Initiatives: Eco-friendly practices, reducing waste, and carbon footprint in cheese production

- Plant-Based Alternatives: Rise of vegan cheese options and market growth

- Artisan Cheese Trends: Unique flavors, local production, and consumer demand for craft cheeses

- Supply Chain Challenges: Global logistics, labor shortages, and rising costs impacting the industry

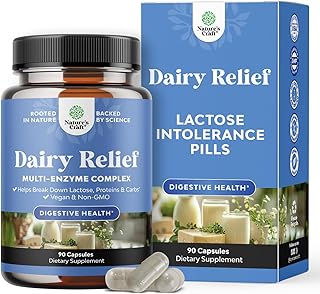

- Health-Focused Innovations: Low-fat, lactose-free, and probiotic-rich cheese products gaining popularity

Sustainability Initiatives: Eco-friendly practices, reducing waste, and carbon footprint in cheese production

The cheese industry, a cornerstone of global dairy production, is increasingly under scrutiny for its environmental impact. From energy-intensive processing to methane emissions from livestock, the sector contributes significantly to the food industry's carbon footprint. However, a wave of sustainability initiatives is transforming how cheese is made, packaged, and consumed. These efforts focus on eco-friendly practices, waste reduction, and carbon footprint mitigation, offering a blueprint for a greener future.

One of the most impactful strategies is the adoption of renewable energy in cheese production. Dairies are investing in solar panels, wind turbines, and biogas systems to power their operations. For instance, some European cheese producers have transitioned to 100% renewable energy, slashing their carbon emissions by up to 50%. Biogas, produced from manure and whey, not only provides energy but also reduces methane emissions from livestock waste. For smaller producers, even partial adoption of solar energy can yield significant savings—a 10 kW solar system can offset approximately 15,000 lbs of CO2 annually, equivalent to planting 180 trees.

Waste reduction is another critical area of focus. Cheese production generates substantial byproducts, such as whey and brine, which are often discarded. Innovative solutions are turning these wastes into valuable resources. Whey, for example, is now being used in animal feed, bioplastics, and even as a base for protein supplements. Some companies are also repurposing brine for de-icing roads or as a natural preservative. By closing the loop on waste, producers can reduce their environmental impact while creating new revenue streams. A case study from a Wisconsin dairy found that repurposing whey reduced their waste output by 40% and increased profitability by 15%.

Packaging is a third frontier in sustainability. Traditional cheese packaging relies heavily on plastic, which contributes to pollution and takes centuries to decompose. Biodegradable and compostable materials, such as cornstarch-based films and wax coatings, are gaining traction. Some brands have introduced reusable packaging systems, where consumers return containers for refilling. For example, a Dutch cheese company reduced its plastic use by 70% by switching to plant-based packaging. While these alternatives can be more expensive, they align with growing consumer demand for eco-friendly products. A survey by Nielsen found that 73% of global consumers would pay more for sustainable goods, signaling a market ripe for innovation.

Finally, regenerative farming practices are reshaping the dairy industry's approach to sustainability. By focusing on soil health, biodiversity, and animal welfare, farmers can sequester carbon, reduce erosion, and enhance ecosystem resilience. Rotational grazing, cover cropping, and reduced tillage are among the techniques being adopted. A study by the Rodale Institute found that regenerative practices can sequester up to 1 ton of CO2 per acre annually. For cheese producers, partnering with regenerative farms not only reduces their carbon footprint but also strengthens their brand as stewards of the environment.

In conclusion, sustainability initiatives in cheese production are multifaceted, addressing energy use, waste, packaging, and farming practices. While challenges remain, the industry’s progress demonstrates that eco-friendly practices are not only feasible but also profitable. By embracing innovation and consumer demand, cheese producers can lead the way in creating a more sustainable food system.

Is a Wedge of Cheese a Prism or Pyramid? Exploring 3D Shapes

You may want to see also

Plant-Based Alternatives: Rise of vegan cheese options and market growth

The global cheese industry, traditionally rooted in dairy, is witnessing a seismic shift as plant-based alternatives carve out a significant niche. Vegan cheese, once a niche product, is now a dynamic and rapidly growing segment, driven by changing consumer preferences, advancements in food technology, and heightened environmental awareness. This transformation is not just a trend but a reflection of a broader cultural and economic movement toward sustainability and health-conscious living.

Consider the numbers: the plant-based cheese market is projected to grow at a compound annual growth rate (CAGR) of over 10% from 2023 to 2030, outpacing the traditional dairy sector. Brands like Violife, Daiya, and Miyoko’s Creamery are leading the charge, offering products that mimic the texture, melt, and flavor profiles of dairy cheese with remarkable accuracy. For instance, Miyoko’s uses cultured cashew milk to create aged cheeses, while Violife’s coconut oil-based products are praised for their versatility in cooking. These innovations are not just appealing to vegans; they’re attracting flexitarians and lactose-intolerant consumers seeking dairy-free options without compromising taste.

However, the rise of vegan cheese isn’t without challenges. Critics argue that some plant-based cheeses lack the complexity of their dairy counterparts, often relying on additives like stabilizers and natural flavors to achieve the desired consistency. For consumers, navigating this landscape requires discernment. Look for products with short ingredient lists and recognizable components, such as nuts, seeds, or legumes. For example, almond-based cheeses tend to have a cleaner profile compared to highly processed soy-based alternatives. Additionally, pairing vegan cheese with the right dishes can enhance its appeal—try a cashew-based cheddar on a plant-based burger or a nut-based brie with crackers for a sophisticated appetizer.

From a market perspective, the growth of vegan cheese is reshaping supply chains and investment patterns. Major dairy companies like Danone and Kraft Heinz are acquiring or launching plant-based lines to diversify their portfolios, signaling a strategic shift in the industry. Retailers are also expanding their offerings, with dedicated plant-based sections becoming commonplace in supermarkets worldwide. For entrepreneurs and investors, this presents an opportunity to innovate further, whether through developing new fermentation techniques or creating cheese alternatives from unconventional sources like watermelon seeds or fermented peas.

In conclusion, the rise of vegan cheese is more than a dietary fad—it’s a testament to the power of innovation and consumer demand in reshaping industries. As technology continues to bridge the gap between plant-based and dairy cheeses, the market will likely see even greater diversification and acceptance. For consumers, this means more choices and the ability to align their dietary preferences with their values. For the cheese industry, it’s a call to adapt, evolve, and embrace a future where cheese can be both indulgent and sustainable.

Wisconsin's Cheese Monopoly: Economic, Cultural, and Global Implications Explored

You may want to see also

Artisan Cheese Trends: Unique flavors, local production, and consumer demand for craft cheeses

The artisan cheese industry is experiencing a renaissance, driven by a trifecta of trends: unique flavors, local production, and surging consumer demand for craft cheeses. This shift reflects a broader cultural movement toward authenticity, sustainability, and experiential consumption. For instance, cheeses infused with unconventional ingredients like truffle, lavender, or even beer are no longer niche but mainstream, with sales of specialty cheeses growing by 5.2% annually, outpacing conventional varieties. This trend isn’t just about taste—it’s about storytelling, as consumers seek cheeses with a narrative, whether it’s a family-owned farm or a centuries-old recipe.

To capitalize on this trend, producers are experimenting with bold flavor profiles that challenge traditional norms. Take, for example, the rise of ash-rind cheeses, which combine a striking appearance with a complex, earthy flavor. Or consider the growing popularity of blue cheeses aged in spirits barrels, imparting notes of whiskey or wine. For home enthusiasts, recreating these flavors can be as simple as experimenting with local ingredients—adding a pinch of smoked paprika or a drizzle of honey during the aging process. The key is to balance innovation with respect for the craft, ensuring the cheese remains approachable yet distinctive.

Local production is another cornerstone of this movement, as consumers increasingly prioritize sustainability and community support. Artisan cheesemakers are leveraging this by sourcing milk from nearby farms, reducing their carbon footprint and fostering transparency. For example, in Vermont, small-batch producers like Jasper Hill Farm have built a loyal following by highlighting their partnerships with local dairy farmers. Consumers can support this trend by seeking out farmers’ markets or joining cheese subscription boxes that feature regional varieties. Pro tip: Look for certifications like "Animal Welfare Approved" or "Organic" to ensure ethical practices.

Finally, the demand for craft cheeses is being fueled by a younger, more adventurous demographic. Millennials and Gen Z, in particular, are willing to pay a premium for high-quality, artisanal products, with 63% of these groups reporting they’d choose craft cheese over mass-produced options. This presents an opportunity for retailers to curate diverse cheese boards or host tasting events that educate consumers about the nuances of different varieties. For home entertaining, pair a sharp cheddar with a local craft beer or serve a creamy Brie alongside a seasonal jam to elevate the experience. The takeaway? Artisan cheese isn’t just food—it’s a conversation starter, a cultural artifact, and a gateway to deeper culinary exploration.

Peanut vs. Cheese Ball: Which Snack Packs More Kilocalories?

You may want to see also

Explore related products

Supply Chain Challenges: Global logistics, labor shortages, and rising costs impacting the industry

The cheese industry, a global powerhouse valued at over $100 billion, is facing unprecedented supply chain disruptions. From the dairy farms of Wisconsin to the aging cellars of France, producers are grappling with a trifecta of challenges: global logistics bottlenecks, labor shortages, and skyrocketing costs. These issues are not isolated incidents but interconnected symptoms of a system under strain, threatening the availability and affordability of cheese worldwide.

Consider the journey of a wheel of Parmigiano Reggiano. Its production relies on a delicate dance of milk collection, curdling, pressing, and aging, a process that can take over two years. Now, imagine this process disrupted by delayed shipments of rennet from Europe, a shortage of skilled cheesemakers, and a 20% increase in the cost of milk. This scenario is not hypothetical; it’s the reality for many producers. Global logistics, once a well-oiled machine, has been thrown into chaos by port congestion, reduced shipping capacity, and unpredictable weather events. For instance, a single container of cheese traveling from Italy to the U.S. can now take up to 60 days, compared to 30 days pre-pandemic, with freight costs surging by 300% in some cases.

Labor shortages compound this crisis. The cheese industry, like many sectors, relies heavily on manual labor for milking, processing, and packaging. In the U.S., dairy farms are reporting a 15-20% labor deficit, exacerbated by immigration policies and the pandemic’s impact on worker availability. In Europe, aging populations and a lack of interest among younger generations in traditional cheesemaking roles are creating a skills gap. For example, France, home to over 1,000 varieties of cheese, is struggling to find enough affineurs—experts who oversee the aging process—to maintain production levels.

Rising costs are the final blow. Feed, energy, and packaging prices have soared, squeezing profit margins for producers. A 2023 report by the International Dairy Foods Association highlights that the cost of producing a pound of cheddar has increased by 25% in the past two years. These costs are inevitably passed on to consumers, with retail cheese prices rising by 10-15% globally. Small-scale producers, already operating on thin margins, are particularly vulnerable. For instance, a family-owned cheddar producer in Vermont saw their electricity bill double in 2022, forcing them to reduce production by 30% to stay afloat.

To navigate these challenges, the industry must innovate. Producers are exploring local sourcing to reduce reliance on global supply chains, investing in automation to address labor shortages, and adopting energy-efficient technologies to curb rising costs. Consumers, too, have a role to play by supporting local cheesemakers and embracing seasonal varieties. While the road ahead is uncertain, one thing is clear: the cheese industry’s resilience will be tested like never before.

Shredded Cheese Measurements: Grams in a Tablespoon Explained

You may want to see also

Health-Focused Innovations: Low-fat, lactose-free, and probiotic-rich cheese products gaining popularity

The global cheese industry is witnessing a significant shift towards health-conscious consumers, driving the development of innovative cheese products that cater to specific dietary needs and preferences. Among these innovations, low-fat, lactose-free, and probiotic-rich cheeses are gaining traction, as they offer a healthier alternative to traditional cheese without compromising on taste and texture. For instance, low-fat cheese options, which typically contain 3-8 grams of fat per ounce compared to 9-12 grams in regular cheese, are becoming increasingly popular among weight-conscious individuals.

To understand the appeal of these health-focused cheese products, consider the following scenario: a 35-year-old fitness enthusiast who loves cheese but wants to maintain a low-fat diet. By opting for low-fat cheese, they can still enjoy their favorite food while adhering to their dietary restrictions. Moreover, lactose-free cheese, which is treated with lactase enzyme to break down lactose, is a game-changer for the estimated 65% of the global population that has a reduced ability to digest lactose after infancy. This innovation enables lactose-intolerant individuals to savor cheese without experiencing digestive discomfort. When selecting lactose-free cheese, look for products that contain less than 0.5 grams of lactose per serving, as this is the threshold below which most people can tolerate lactose.

In the realm of probiotic-rich cheese, products like Gouda and Cheddar are being infused with beneficial bacteria strains, such as Lactobacillus and Bifidobacterium, at a concentration of 1-10 billion colony-forming units (CFUs) per serving. These probiotics can help improve gut health, boost immunity, and even alleviate symptoms of irritable bowel syndrome (IBS). To maximize the benefits of probiotic-rich cheese, pair it with prebiotic-rich foods like garlic, onions, and bananas, which provide fuel for the beneficial bacteria. Additionally, store probiotic cheese at temperatures below 40°F (4°C) to preserve the viability of the live cultures.

A comparative analysis of these health-focused cheese products reveals that each type caters to a specific health concern. Low-fat cheese targets weight management, lactose-free cheese addresses lactose intolerance, and probiotic-rich cheese promotes gut health. When incorporating these products into your diet, consider the following practical tips: gradually introduce low-fat cheese to allow your taste buds to adjust; choose aged lactose-free cheese, as the aging process naturally reduces lactose content; and consume probiotic-rich cheese consistently, as the benefits of probiotics are dose-dependent and require regular intake. By embracing these health-focused cheese innovations, consumers can enjoy the sensory pleasures of cheese while supporting their overall well-being.

As the demand for healthier cheese options continues to rise, manufacturers are investing in research and development to create products that meet the evolving needs of consumers. For example, some companies are experimenting with plant-based rennet and microbial transglutaminase to produce low-fat cheese with improved texture and flavor. Others are exploring the use of precision fermentation to create lactose-free cheese with a more authentic taste. Meanwhile, advancements in probiotic technology are enabling the production of cheese with targeted health benefits, such as improved bone health or reduced inflammation. By staying informed about these innovations and making informed choices, consumers can navigate the world of health-focused cheese products with confidence and enjoy the many benefits they offer.

Unveiling the Crunchy Mystery: Cheetos Cheese Puffs Ingredients Explained

You may want to see also

Frequently asked questions

The cheese industry is seeing a rise in demand for artisanal, organic, and plant-based cheeses, driven by consumer preferences for healthier and sustainable options. Additionally, there’s a growing interest in global cheese varieties, with consumers exploring flavors beyond traditional European styles.

Technology is revolutionizing the cheese industry through automation, precision fermentation, and data-driven quality control. Innovations like AI-powered aging processes and blockchain for supply chain transparency are enhancing efficiency and traceability.

The industry faces challenges such as rising dairy costs, labor shortages, and environmental concerns related to dairy farming. Additionally, regulatory changes and shifting consumer diets (e.g., reduced dairy consumption) are impacting market dynamics.