The price of cheese in China varies significantly depending on factors such as type, brand, and region. Unlike in Western countries where cheese is a staple, China’s cheese market is relatively niche, with prices generally higher due to import costs and limited local production. Domestic cheeses, often made from goat or yak milk, are more affordable but less common, while imported varieties like cheddar, mozzarella, or brie can be significantly more expensive, often found in specialty stores or high-end supermarkets. Economic hubs like Beijing and Shanghai typically have higher prices compared to rural areas, and fluctuations in global dairy markets and tariffs also influence costs. Understanding these dynamics is key to grasping the pricing landscape of cheese in China.

Explore related products

What You'll Learn

Cheese types and prices

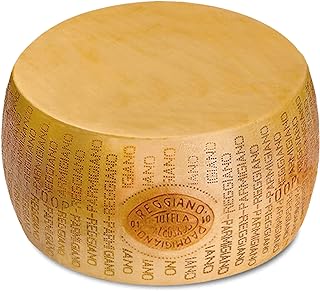

China's cheese market is a fascinating blend of tradition and modernity, with prices reflecting a wide range of factors, from production methods to consumer preferences. For instance, a 200g block of locally produced cheddar in Beijing can cost around ¥20-¥30 (approximately $3-$4.50), while imported varieties like French Brie or Italian Parmesan can soar to ¥100-¥200 ($15-$30) for the same quantity. This disparity highlights the premium placed on authenticity and origin, as well as the growing demand for diverse cheese types among China’s increasingly globalized population.

Analyzing the price spectrum, it’s clear that cheese types play a pivotal role in determining cost. Domestic cheeses, often mass-produced and milder in flavor, cater to a broader audience and remain affordable. In contrast, artisanal or imported cheeses, such as Gouda or Blue Cheese, are priced higher due to limited availability, specialized production techniques, and import tariffs. For example, a 150g wheel of imported Camembert can cost upwards of ¥80 ($12), whereas a similar-sized domestic imitation might be priced at ¥25 ($3.75). This gap underscores the value consumers place on quality and authenticity, even in a market where cheese is not a traditional staple.

For those looking to navigate China’s cheese market, understanding regional preferences is key. In urban areas like Shanghai and Guangzhou, where Western influences are stronger, demand for premium and exotic cheeses drives prices upward. Conversely, in rural regions, simpler, more affordable varieties dominate. A practical tip for budget-conscious consumers is to explore local supermarkets or wet markets, where prices are often lower than in specialty stores. Additionally, buying in bulk or during promotions can significantly reduce costs, especially for imported cheeses.

Comparatively, China’s cheese prices also reflect global trends. While still higher than in traditional cheese-producing countries like France or Italy, they are becoming more competitive as local production increases and import channels streamline. For instance, the price of a 1kg block of mozzarella in China averages ¥150 ($22), compared to ¥100 ($15) in Italy. However, this gap is narrowing as Chinese dairy farms adopt advanced techniques and cater to the growing appetite for cheese in the country. This evolution suggests that both prices and variety will continue to diversify, making cheese more accessible to a wider audience.

In conclusion, the price of cheese in China is a dynamic interplay of type, origin, and market demand. From affordable domestic options to premium imports, consumers have a growing array of choices, though prices vary significantly. By understanding these factors and adopting smart shopping strategies, cheese enthusiasts can enjoy their favorite varieties without breaking the bank. As the market matures, it’s likely that both prices and availability will become even more favorable, further embedding cheese into China’s culinary landscape.

Discover Cheeses Similar to Kraft Cracker Barrel for Your Pantry

You may want to see also

Regional price variations

China's vast geography and diverse economic landscape mean that the price of cheese can vary significantly from one region to another. For instance, in major urban centers like Beijing and Shanghai, where demand for imported and specialty cheeses is higher, prices tend to be more elevated. A 200g block of imported cheddar might cost around ¥50-¥70 (approximately $7-$10), while the same product in smaller cities or rural areas could be harder to find and priced differently due to lower demand and higher distribution costs.

Analyzing these regional disparities reveals a direct correlation between economic development and cheese pricing. In wealthier coastal provinces, such as Guangdong and Zhejiang, consumers are more willing to pay a premium for high-quality, imported cheeses. Conversely, in inland regions like Sichuan or Yunnan, local dairy products often dominate the market, and cheese prices are generally lower, reflecting both production costs and consumer purchasing power. For example, domestically produced cheese in these areas might sell for as little as ¥20-¥30 ($3-$4) for a similar quantity, making it more accessible to a broader population.

To navigate these variations, consumers should consider a few practical strategies. First, research local markets and supermarkets to compare prices, as smaller, independent stores in rural areas may offer better deals than large chains. Second, explore domestically produced cheeses, which are often more affordable and increasingly competitive in quality. Finally, for those in urban areas, consider purchasing in bulk or during promotions, as imported cheeses can sometimes be discounted by up to 20-30% during sales events.

A comparative analysis of regional pricing also highlights the role of government policies and tariffs. Imported cheeses in China are subject to tariffs ranging from 10% to 15%, depending on the country of origin, which significantly impacts the final retail price. In regions with free trade zones, such as Shanghai, these tariffs may be reduced, leading to slightly lower prices for imported products. Understanding these policy nuances can help consumers make more informed purchasing decisions, especially when budgeting for specialty items.

In conclusion, regional price variations in China’s cheese market are shaped by a combination of economic factors, consumer preferences, and policy influences. By understanding these dynamics, consumers can strategically source cheese at the best possible prices, whether opting for imported varieties in urban centers or exploring locally produced options in other areas. This knowledge not only saves money but also enhances appreciation for the diverse dairy landscape across China.

Cheese Measurement: Fluid Ounces or Dry Ounces – Which is Correct?

You may want to see also

Import vs. local cheese costs

The price of cheese in China varies significantly depending on whether it’s imported or locally produced. Imported cheeses, particularly those from Europe or the United States, often carry a premium due to tariffs, transportation costs, and brand reputation. For instance, a 200g block of French Brie can cost upwards of ¥80–¥120 (approximately $11–$17), while a similar-sized local Chinese cheese might range from ¥20–¥40 ($3–$6). This price gap highlights the economic and logistical factors that influence consumer choices in the Chinese market.

Analyzing the cost structure reveals why imported cheeses are pricier. Tariffs on dairy products in China can reach 12–15%, and additional costs like refrigeration during shipping and local distribution further inflate prices. Local cheeses, on the other hand, benefit from lower production costs and shorter supply chains. For example, domestic brands like Bright Dairy & Food produce cheeses priced at ¥30–¥50 per 200g, making them more accessible to budget-conscious consumers. However, quality and variety often favor imports, as local producers are still catching up in terms of flavor profiles and specialty offerings.

For consumers, the choice between imported and local cheese depends on priorities. If you’re hosting a dinner party and want to impress with a creamy Camembert or sharp Cheddar, budgeting for imports is advisable. However, for everyday use in cooking or sandwiches, local options like processed cheese slices or mozzarella from brands like Yili or Mengniu offer affordability without compromising on basic quality. A practical tip: check duty-free shops or international supermarkets for imported cheeses at slightly lower prices, though availability may vary.

A comparative study of consumer behavior shows that younger, urban Chinese consumers are more willing to pay for imported cheeses, viewing them as a symbol of sophistication and global taste. In contrast, older generations and rural populations tend to favor local cheeses due to their lower cost and familiarity. This demographic divide underscores the evolving cheese market in China, where both imported and local products have distinct roles to play. By understanding these cost dynamics, consumers can make informed decisions that align with their preferences and budgets.

Easy Ricotta Draining Hacks: No Cheesecloth Required for Creamy Results

You may want to see also

Explore related products

Market trends and fluctuations

The price of cheese in China has been influenced by a complex interplay of domestic production, import dynamics, and shifting consumer preferences. Over the past decade, China’s cheese market has grown exponentially, driven by urbanization, Western dietary influences, and a rising middle class. However, this growth has not been linear; fluctuations in global dairy prices, trade policies, and local supply chain challenges have created volatility. For instance, the average price of imported cheese in China increased by 15% between 2020 and 2022, partly due to disruptions caused by the COVID-19 pandemic and rising freight costs.

Analyzing these trends reveals a critical insight: China’s cheese market is highly sensitive to external factors. The country relies heavily on imports, with over 80% of its cheese supply coming from countries like New Zealand, the Netherlands, and France. When global dairy prices surge—as they did in 2022 due to feed shortages and energy costs—Chinese consumers feel the impact almost immediately. Conversely, domestic production, though growing, remains limited by factors such as high production costs and a lack of dairy farming infrastructure. This imbalance leaves the market vulnerable to price shocks, making it essential for consumers and businesses to monitor global dairy indices like the Global Dairy Trade (GDT) auction prices.

To navigate these fluctuations, consumers and retailers can adopt strategic purchasing practices. For example, buying in bulk during periods of low global dairy prices can mitigate the impact of future price hikes. Additionally, exploring locally produced cheese options, though currently more expensive, supports domestic growth and reduces reliance on imports. Retailers, on the other hand, should diversify their supply chains to include multiple import sources, reducing the risk of disruptions from any single country. Implementing dynamic pricing models based on real-time market data can also help maintain profitability while offering competitive prices to consumers.

A comparative analysis of cheese prices in China versus other Asian markets highlights the unique challenges and opportunities in the region. In Japan, for instance, cheese prices are generally higher due to strong domestic demand and a well-established dairy industry. In contrast, India’s cheese market is growing rapidly but remains price-sensitive, with consumers favoring lower-cost options. China sits in the middle, with a premium segment driven by imported cheeses and a growing mid-range market for locally produced alternatives. This positioning suggests that China’s cheese market has room for both high-end and affordable products, provided businesses can manage cost fluctuations effectively.

In conclusion, understanding market trends and fluctuations in China’s cheese industry requires a multifaceted approach. By staying informed about global dairy prices, diversifying supply chains, and adopting strategic purchasing practices, stakeholders can navigate the volatility of this dynamic market. As China’s cheese consumption continues to rise, the ability to adapt to these trends will be crucial for both consumers and businesses alike.

Unraveling Paul Delmonte's Role in 'I Am the Cheese' Mystery

You may want to see also

Consumer demand impact on pricing

Cheese prices in China are not solely determined by production costs or market trends; consumer demand plays a pivotal role in shaping price fluctuations. As Chinese consumers increasingly adopt Western dietary habits, the demand for cheese has surged, particularly among urban, middle-class households. This shift in consumption patterns has led to a premium on imported cheeses, which are often perceived as higher quality. For instance, a 200g block of imported cheddar can cost upwards of ¥50 (approximately $7), while domestically produced cheese may be priced 30-40% lower. This disparity highlights how consumer preference for foreign brands directly influences pricing strategies.

To understand the impact of demand on pricing, consider the seasonal spikes in cheese consumption. During festivals like Christmas or New Year, when cheese is a popular ingredient in holiday dishes, prices can rise by 15-20%. Retailers and suppliers capitalize on this heightened demand, adjusting prices to maximize profits. Conversely, during off-peak seasons, prices may stabilize or even drop as suppliers seek to maintain sales volume. This dynamic illustrates how consumer behavior, driven by cultural and seasonal factors, directly affects the price of cheese in China.

A persuasive argument can be made for the role of marketing in shaping demand and, consequently, pricing. Imported cheese brands often invest heavily in campaigns that position their products as luxurious or health-conscious, appealing to China’s growing health-aware demographic. These marketing efforts create a perception of value, allowing brands to command higher prices. For example, organic or artisanal cheeses can fetch prices 2-3 times higher than standard varieties, even if production costs are only marginally different. This demonstrates how consumer demand, influenced by marketing narratives, can justify premium pricing.

Comparatively, the rise of e-commerce platforms has democratized access to cheese in China, but it has also introduced pricing complexities. Online retailers often offer discounts or bundle deals to attract price-sensitive consumers, while simultaneously listing premium options at higher price points. This dual strategy caters to diverse consumer segments, from budget-conscious buyers to those willing to pay more for quality. However, it also creates a fragmented pricing landscape, where the same product can vary in price by as much as 20% across platforms. This variability underscores the influence of consumer demand on pricing strategies in the digital marketplace.

Finally, a practical takeaway for consumers is to monitor demand trends and purchase cheese strategically. Buying in bulk during off-peak seasons or opting for domestically produced varieties can yield significant savings. Additionally, leveraging price comparison tools on e-commerce platforms can help identify the best deals. By understanding how demand impacts pricing, consumers can make informed decisions that balance quality and affordability in their cheese purchases.

Mastering Hollow Knight: Cheesing the Delicate Flower Boss Fight

You may want to see also

Frequently asked questions

The average price of cheese in China varies depending on the type and brand, but it generally ranges from ¥30 to ¥150 (approximately $4 to $20) per kilogram for locally produced or imported varieties.

Yes, cheese is often more expensive in China compared to Western countries due to high import costs, limited local production, and lower demand, making it a specialty item.

The price of cheese in China is influenced by import tariffs, transportation costs, local production capacity, brand reputation, and consumer demand for specialty or imported products.

Yes, affordable cheese options are available, particularly locally produced varieties like processed cheese slices or blocks, which can cost as low as ¥10 to ¥20 (approximately $1.50 to $3) per pack.

Imported cheese is typically more expensive, often costing 2-3 times more than locally produced cheese due to higher production standards, brand value, and import-related expenses.