When exploring the global cheese production landscape, one region stands out as the largest producer: the European Union. With a rich history of dairy farming and cheese-making traditions, the EU accounts for over half of the world's cheese production, led by countries such as France, Germany, Italy, and the Netherlands. These nations are renowned for their diverse range of cheeses, from the creamy Brie and Camembert to the hard, aged Parmigiano-Reggiano and Gouda. The EU's dominance in cheese production can be attributed to its favorable climate, fertile soils, and well-established dairy infrastructure, as well as its strong cultural heritage and commitment to preserving traditional cheese-making techniques. As a result, the European Union remains the undisputed leader in the global cheese market, shaping the industry's trends and standards.

Explore related products

What You'll Learn

- Europe's Dominance: Europe leads global cheese production, with countries like France, Italy, and Germany as top producers

- United States Role: The U.S. is the largest single-country producer, focusing on cheddar and mozzarella

- New Zealand's Growth: Known for dairy, New Zealand excels in cheese exports, particularly cheddar and specialty varieties

- Brazil's Rise: Brazil is a major cheese producer in South America, with increasing output in recent years

- Asia's Emerging Market: Countries like India and China are growing in cheese production due to rising demand

Europe's Dominance: Europe leads global cheese production, with countries like France, Italy, and Germany as top producers

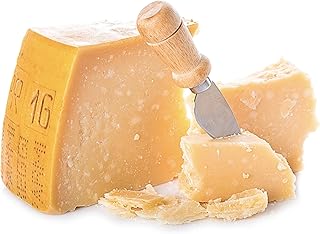

Europe's dominance in global cheese production is undeniable, with the continent accounting for over 50% of the world's cheese output. This supremacy is rooted in a combination of historical tradition, diverse dairy practices, and stringent quality standards. Countries like France, Italy, and Germany stand out as the titans of this industry, each contributing uniquely to the global cheese market. France, for instance, produces approximately 1.5 million tons of cheese annually, with iconic varieties like Brie and Camembert leading the charge. Italy follows closely, renowned for its Parmigiano-Reggiano and Mozzarella, while Germany excels in mass production of cheeses like Gouda and Edam.

To understand Europe's edge, consider the region's dairy infrastructure. European countries invest heavily in advanced dairy technology and sustainable farming practices, ensuring high yields without compromising quality. For example, France’s Appellation d'Origine Protégée (AOP) system guarantees that cheeses like Roquefort are produced using traditional methods in specific regions, preserving both heritage and flavor. Similarly, Italy’s Protected Designation of Origin (PDO) status for cheeses like Pecorino Romano ensures authenticity and traceability. These certifications not only elevate European cheeses but also command premium prices in global markets.

A comparative analysis reveals why Europe outpaces other regions. While the United States is the largest single-country producer, its focus on mass-market cheeses like Cheddar and Mozzarella lacks the diversity and artisanal craftsmanship found in Europe. In contrast, European producers cater to niche markets, offering over 1,400 distinct cheese varieties. This diversity is a result of centuries-old traditions, regional specialization, and a cultural appreciation for cheese as a culinary art. For instance, Switzerland’s Emmental and the Netherlands’ Gouda are not just products but symbols of national identity.

For consumers and industry players, Europe’s dominance offers practical takeaways. When selecting cheese, look for AOP or PDO labels to ensure authenticity and quality. Pairing European cheeses with regional wines or incorporating them into recipes can elevate culinary experiences. For businesses, investing in European cheese imports or adopting their production techniques can tap into growing consumer demand for premium, artisanal products. Europe’s leadership in cheese production is not just about quantity but about setting global standards for excellence and innovation.

In conclusion, Europe’s dominance in cheese production is a testament to its ability to blend tradition with modernity. By prioritizing quality, diversity, and heritage, countries like France, Italy, and Germany have cemented their positions as global leaders. Whether you’re a cheese enthusiast or a market analyst, understanding Europe’s role in this industry provides valuable insights into the intersection of culture, craftsmanship, and commerce.

Mastering the Art of French Cheese Boards: A Step-by-Step Guide

You may want to see also

United States Role: The U.S. is the largest single-country producer, focusing on cheddar and mozzarella

The United States stands as the largest single-country producer of cheese globally, a title it has held for several decades. This dominance is driven by its focus on two varieties: cheddar and mozzarella, which together account for over 50% of the nation’s cheese production. These cheeses are not only staples in American diets but also key exports, shaping the global cheese market. Wisconsin, California, and Idaho lead as the top cheese-producing states, leveraging advanced dairy farming techniques and large-scale processing facilities to meet both domestic and international demand.

Analyzing the U.S. cheese industry reveals a strategic emphasis on efficiency and scalability. Cheddar, known for its versatility, is used in everything from sandwiches to sauces, while mozzarella dominates the pizza and pasta sectors. This dual focus allows the U.S. to cater to diverse consumer preferences and industrial needs. For instance, the average American consumes approximately 40 pounds of cheese annually, with cheddar and mozzarella making up a significant portion. This high demand is met through innovations like automated curd pressing and rapid cooling systems, ensuring consistent quality and supply.

To understand the U.S. role in global cheese production, consider this comparative perspective: while the European Union produces more cheese collectively, its output is fragmented across multiple countries. The U.S., in contrast, consolidates production within a single nation, streamlining logistics and reducing costs. For example, Wisconsin alone produces over 3 billion pounds of cheese annually, surpassing the total output of many European countries. This centralized approach gives the U.S. a competitive edge in both price and distribution.

For those looking to incorporate U.S.-produced cheddar or mozzarella into their diets, practical tips can enhance the experience. Cheddar pairs well with apples or crackers for a simple snack, while mozzarella shines in dishes like caprese salad or homemade pizza. When purchasing, opt for block cheese over pre-shredded varieties, as it contains fewer additives and melts more evenly. Additionally, storing cheese in the vegetable drawer of your refrigerator, wrapped in wax paper, preserves its texture and flavor longer.

In conclusion, the U.S. role as the largest single-country cheese producer is defined by its strategic focus on cheddar and mozzarella, supported by advanced production techniques and high consumer demand. This dominance not only shapes the global cheese market but also offers practical benefits for consumers, from affordability to versatility. Whether enjoyed in a grilled cheese sandwich or a margherita pizza, U.S.-produced cheeses remain a cornerstone of modern cuisine.

Global Cheese Leader: Which Country Produces the Most Cheese?

You may want to see also

New Zealand's Growth: Known for dairy, New Zealand excels in cheese exports, particularly cheddar and specialty varieties

New Zealand, a nation synonymous with lush pastures and dairy excellence, has carved a niche in the global cheese market, particularly with its cheddar and specialty varieties. While the European Union dominates as the largest cheese producer, New Zealand’s growth in cheese exports is noteworthy, driven by its commitment to quality, innovation, and sustainable practices. The country’s temperate climate and grass-fed dairy herds yield milk rich in flavor, a key factor in the distinct taste of its cheeses. This unique advantage has positioned New Zealand as a formidable player in the international cheese trade, especially in high-demand markets like Asia and North America.

To understand New Zealand’s success, consider the strategic focus on cheddar, a versatile cheese that appeals to both mass markets and artisanal consumers. New Zealand produces over 100,000 metric tons of cheddar annually, accounting for a significant portion of its cheese exports. The country’s cheddar is prized for its creamy texture and sharp, nutty flavors, achieved through traditional aging techniques. For instance, a 12-month aged New Zealand cheddar is a staple in gourmet cheese boards, offering a depth of flavor that rivals European counterparts. This focus on quality has allowed New Zealand to command premium prices, even in competitive markets.

Beyond cheddar, New Zealand’s specialty cheeses are gaining global recognition. Varieties like aged gouda, blue cheese, and organic halloumi showcase the country’s ability to innovate while maintaining its dairy heritage. For example, New Zealand’s organic halloumi, made from milk sourced from pasture-raised cows, has become a favorite in health-conscious markets. Its high melting point and distinctive texture make it ideal for grilling, a trend that has boosted its popularity in both home kitchens and restaurants. These specialty cheeses not only diversify New Zealand’s export portfolio but also cater to evolving consumer preferences for unique, high-quality products.

A key takeaway for cheese producers and enthusiasts alike is New Zealand’s emphasis on sustainability and traceability. The country’s dairy industry operates under strict environmental regulations, ensuring that cheese production minimizes its ecological footprint. Consumers increasingly value transparency, and New Zealand’s ability to trace its cheese from farm to table resonates with this demand. For those looking to incorporate New Zealand cheese into their diet, pairing a sharp cheddar with a local craft beer or using organic halloumi in a Mediterranean salad can elevate everyday meals. As New Zealand continues to innovate and expand its cheese offerings, its growth story serves as a blueprint for balancing tradition, quality, and sustainability in the global dairy market.

Crafting the Perfect Cheese and Salami Platter: Tips and Tricks

You may want to see also

Explore related products

$27.59 $49.95

Brazil's Rise: Brazil is a major cheese producer in South America, with increasing output in recent years

Brazil's cheese production has surged, positioning it as a key player in South America's dairy landscape. With an annual output exceeding 1.4 million metric tons, the country now rivals traditional regional leaders like Argentina. This growth is fueled by a combination of expanding dairy herds, improved farming technologies, and a shift toward higher-yielding cattle breeds such as Holstein-Friesian. The result? A 15% increase in production over the past five years, outpacing the global average.

This rise isn’t just about quantity—it’s about diversity. Brazil produces over 50 types of cheese, from the ubiquitous Minas Frescal to the increasingly popular artisanal varieties like Queijo Coalho. The latter, often grilled and served at street food stalls, has become a cultural staple, driving domestic demand. Meanwhile, exports are climbing, particularly to neighboring countries like Uruguay and Paraguay, where Brazilian cheese is prized for its quality and affordability.

However, challenges remain. Smallholder farmers, who account for 70% of Brazil’s dairy production, often lack access to modern processing facilities. This limits their ability to meet international standards and compete globally. To address this, the government has launched initiatives like the *Plano Safra*, which provides subsidies for equipment upgrades and training in food safety protocols. Such efforts are critical to sustaining Brazil’s momentum in the global cheese market.

For consumers and industry players alike, Brazil’s ascent offers both opportunities and lessons. Travelers can explore the country’s cheese trails in regions like Minas Gerais, where traditional methods coexist with innovation. Businesses, meanwhile, should note the potential for partnerships in distribution and technology transfer. As Brazil continues to carve its niche in the cheese world, its story underscores the importance of adaptability and investment in agricultural development.

Slicing Secrets: How Many Cheese Slices in a Pound?

You may want to see also

Asia's Emerging Market: Countries like India and China are growing in cheese production due to rising demand

The European Union has long dominated global cheese production, accounting for over 50% of the world’s supply, with countries like Germany, France, and Italy leading the charge. However, a seismic shift is underway as Asia, particularly India and China, emerges as a formidable player in the cheese market. Driven by changing dietary preferences, urbanization, and rising disposable incomes, these nations are not only increasing their cheese consumption but also ramping up production to meet demand. This transformation challenges the traditional cheese-producing regions and signals a new era in the global dairy industry.

Consider India, where cheese consumption has surged by over 200% in the past decade. Traditionally, dairy products like ghee and paneer dominated Indian cuisine, but exposure to global food trends and the rise of fast-food chains have popularized cheese-based dishes. Local producers are now investing in advanced processing technologies to manufacture mozzarella, cheddar, and processed cheese, reducing reliance on imports. For instance, Gujarat Cooperative Milk Marketing Federation (GCMMF), known for its Amul brand, has expanded its cheese production capacity to 200,000 metric tons annually, catering to both domestic and international markets. This localized production not only ensures fresher products but also creates employment opportunities in rural areas.

China’s cheese market, though smaller than India’s, is growing at an impressive rate of 15% annually. Unlike India, China’s cheese consumption is heavily influenced by Western fast-food chains like Pizza Hut and McDonald’s, which have introduced cheese-laden products to Chinese consumers. Domestic companies, such as Yili and Mengniu, are now partnering with European firms to adopt advanced cheese-making techniques and develop products tailored to local tastes. For example, Yili’s “Cheese Truth” brand offers individually packaged cheese snacks, targeting health-conscious consumers and children. This strategic shift not only boosts production but also positions China as a potential exporter in the Asian cheese market.

Despite the growth, challenges remain. Asia’s cheese producers face hurdles like fluctuating milk prices, limited access to high-quality cattle breeds, and cultural preferences that still favor traditional dairy products. In India, for instance, per capita cheese consumption is just 200 grams annually, compared to 14 kg in the EU. To overcome these barriers, governments and private players must collaborate on initiatives like breed improvement programs, farmer training, and marketing campaigns to educate consumers about cheese’s nutritional benefits. For example, promoting cheese as a protein-rich snack for children or a calcium source for the elderly could drive demand in health-conscious markets like China.

In conclusion, Asia’s emerging cheese market is reshaping the global dairy landscape, with India and China at the forefront. Their focus on localized production, technological innovation, and consumer education not only meets rising demand but also challenges traditional cheese-producing regions. As these nations continue to invest in their dairy sectors, they are poised to become significant players in the global cheese market, offering valuable lessons in adaptability and market diversification. For investors, producers, and consumers alike, Asia’s cheese revolution is a trend worth watching—and tasting.

Grated vs. Block Cheese: Does Weight Differ After Grating?

You may want to see also

Frequently asked questions

The European Union (EU) is the largest producer of cheese globally, accounting for a significant portion of the world's cheese production.

Germany is the largest cheese producer within the EU, followed closely by France and Italy, which are also renowned for their diverse and high-quality cheese varieties.

Yes, the United States is the largest cheese producer outside of Europe, with states like Wisconsin and California leading in production.

Other significant cheese-producing regions include New Zealand, known for its dairy exports, and Brazil, which has a growing cheese industry in South America.

![Saha: A Chef's Journey Through Lebanon and Syria [Middle Eastern Cookbook, 150 Recipes]](https://m.media-amazon.com/images/I/A17ZpuD4FPL._AC_UY218_.jpg)