When it comes to global cheese production, the United States takes the lead as the largest producer, manufacturing over 5 million metric tons of cheese annually. This impressive output is driven by the country's vast dairy industry, advanced technology, and high demand both domestically and internationally. While other nations like Germany, France, and Italy are renowned for their diverse and traditional cheese varieties, the U.S. dominates in sheer volume, making it the top cheese-producing country in the world.

| Characteristics | Values |

|---|---|

| Country | United States |

| Total Cheese Production (2022) | Approximately 5.8 million metric tons |

| Primary Cheese Types Produced | Cheddar, Mozzarella, Pizza Cheese, American Cheese |

| Key Dairy States | Wisconsin, California, Idaho, New York, Pennsylvania |

| Export Volume (2022) | Over 400,000 metric tons |

| Domestic Consumption (2022) | Around 16.5 kg per capita annually |

| Major Export Markets | Mexico, Canada, South Korea, Japan, Middle East |

| Industry Value (2022) | Over $40 billion annually |

| Number of Dairy Farms | Approximately 35,000 |

| Milk Production (2022) | Over 100 billion kg (used for cheese and other dairy products) |

| Technological Advancements | Automation, advanced pasteurization, and cheese-making technologies |

| Sustainability Initiatives | Focus on reducing greenhouse gas emissions and efficient water usage |

Explore related products

What You'll Learn

- Top Cheese Producers: USA, Germany, France, Italy, and Netherlands dominate global cheese production annually

- Production Methods: Industrial vs. artisanal techniques impact quantity and quality of cheese output

- Popular Varieties: Cheddar, mozzarella, and Gouda are among the most produced cheese types

- Export Leaders: EU countries lead in cheese exports, with France and Netherlands topping the list

- Consumption Trends: High production often correlates with domestic consumption and export demand

Top Cheese Producers: USA, Germany, France, Italy, and Netherlands dominate global cheese production annually

The United States leads global cheese production, churning out over 5.5 million metric tons annually. This dominance isn’t just about volume; it’s a reflection of the country’s vast dairy infrastructure, advanced technology, and diverse consumer demand. From cheddar to mozzarella, American cheese production caters to both domestic appetites and international markets, making it a powerhouse in the dairy industry.

Germany follows closely, producing around 2.5 million metric tons of cheese each year. Its success lies in the meticulous craftsmanship of traditional varieties like Gouda and Emmental, combined with efficient industrial processes. German cheese production is a blend of heritage and innovation, appealing to both local and global palates. For enthusiasts, exploring German cheeses offers a journey through centuries-old techniques and modern flavors.

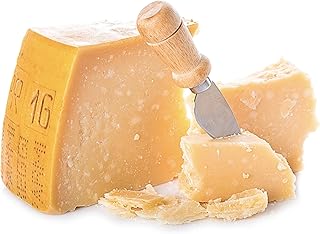

France, Italy, and the Netherlands each contribute uniquely to the global cheese landscape. France produces approximately 1.8 million metric tons annually, with iconic varieties like Brie and Camembert showcasing its cultural influence. Italy, with 1.3 million metric tons, is synonymous with Parmigiano-Reggiano and Mozzarella, embodying the country’s culinary artistry. The Netherlands, producing 800,000 metric tons, excels in export-friendly cheeses like Edam and Gouda, leveraging its strategic geographic position and dairy expertise.

Together, these five nations account for over 60% of the world’s cheese production. Their dominance isn’t accidental—it’s the result of favorable climates, robust dairy industries, and strong export networks. For consumers, this means access to a wide array of cheeses, each with its own story and flavor profile. Whether you’re a chef, a foodie, or a casual cheese lover, understanding these producers’ roles can enhance your appreciation and selection of this timeless food.

To maximize your cheese experience, consider pairing varieties from these top producers with complementary foods and drinks. For instance, American cheddar pairs well with apples and sharp wines, while Dutch Gouda complements dark bread and beer. Experimenting with these combinations not only elevates your palate but also connects you to the rich traditions behind each cheese. In a world dominated by these five producers, every bite is an opportunity to explore global dairy heritage.

Unraveling the Mystery: Who is 'T' in 'I Am the Cheese'?

You may want to see also

Production Methods: Industrial vs. artisanal techniques impact quantity and quality of cheese output

The United States leads global cheese production, with over 6.5 million metric tons annually, surpassing traditional powerhouses like Germany and France. This dominance is largely driven by industrial methods that prioritize efficiency and scalability. However, the debate between industrial and artisanal cheese production persists, as each method significantly impacts both quantity and quality. Understanding these differences is crucial for producers and consumers alike.

Industrial cheese production relies on mechanized processes, standardized recipes, and large-scale facilities to maximize output. For instance, factories use automated pasteurization, mechanical stirring, and rapid aging techniques to produce consistent, high volumes of cheese. A single industrial plant can churn out thousands of pounds of cheddar or mozzarella daily, meeting the demands of global markets. This efficiency is achieved through precise control of temperature, humidity, and microbial cultures, often aided by advanced technology like computer-monitored vats. However, the trade-off lies in the homogenization of flavor and texture, as industrial cheeses often lack the complexity and depth of their artisanal counterparts.

Artisanal cheese production, in contrast, emphasizes tradition, craftsmanship, and small-batch techniques. Artisans rely on manual labor, natural aging processes, and locally sourced milk to create unique, flavor-rich cheeses. For example, a French artisanal cheesemaker might use raw milk from a specific breed of cow, hand-ladle curds, and age the cheese in natural caves for months. This meticulous approach results in cheeses with distinct regional characteristics, such as the nutty complexity of a Comté or the earthy tang of a Roquefort. While artisanal methods yield smaller quantities—often limited to a few hundred pounds per batch—they command premium prices due to their superior quality and cultural significance.

The choice between industrial and artisanal methods ultimately depends on the desired outcome. Industrial production is ideal for meeting mass-market demands, offering affordability and consistency. For instance, shredded mozzarella for pizza chains or sliced cheddar for sandwiches benefit from industrial efficiency. Conversely, artisanal production caters to niche markets, where consumers value authenticity, terroir, and sensory experience. A cheese board featuring artisanal selections can elevate a dining experience, justifying the higher cost.

To bridge the gap, some producers adopt hybrid approaches, combining industrial efficiency with artisanal principles. For example, using traditional recipes but scaling up production with semi-automated equipment allows for increased output without sacrificing quality entirely. This middle ground appeals to consumers seeking both value and flavor. Whether industrial, artisanal, or hybrid, the production method shapes not only the quantity of cheese but also its identity, ensuring there’s a place for every type in the global cheese market.

Why Cats Gag on Cheese: Unraveling the Smelly Mystery

You may want to see also

Popular Varieties: Cheddar, mozzarella, and Gouda are among the most produced cheese types

The United States, Germany, and France dominate global cheese production, but the varieties they produce differ significantly. Among the most produced cheese types worldwide, Cheddar, Mozzarella, and Gouda stand out for their versatility, cultural significance, and economic impact. These cheeses are staples in both industrial and artisanal production, each with distinct characteristics that cater to diverse culinary needs.

Cheddar, originating from England but now a global phenomenon, is the most produced cheese variety in the U.S. and a top contender worldwide. Its popularity stems from its adaptability—ranging from mild to sharp flavors and soft to hard textures—making it ideal for sandwiches, sauces, and snacks. For home cooks, aged Cheddar (12–24 months) adds depth to macaroni and cheese, while younger varieties (3–6 months) melt perfectly for grilled cheese sandwiches. Pairing sharp Cheddar with apples or pears enhances its tangy profile, a tip often overlooked in everyday recipes.

Mozzarella, primarily produced in Italy and the U.S., reigns supreme in the pizza and pasta industries. Its high moisture content and stretchy texture make it indispensable for dishes like Margherita pizza and lasagna. Fresh mozzarella (made from buffalo or cow’s milk) is best consumed within 2–3 days for optimal flavor. For a DIY twist, try making caprese skewers with balsamic glaze, showcasing mozzarella’s mild, milky taste. Interestingly, low-moisture mozzarella is specifically engineered for pizza, ensuring it melts without making the crust soggy.

Gouda, a Dutch export, is the second most produced cheese globally, celebrated for its caramelized, nutty flavors in aged varieties. Young Gouda (4–8 weeks) is mild and creamy, perfect for sandwiches or cheese boards, while aged Gouda (1–2 years) rivals Parmesan in hardness and complexity. Its waxed rind is edible but often removed for cooking. Gouda pairs exceptionally well with dark beer or red wine, a pairing that elevates its rich, buttery notes. For a unique dessert, grate aged Gouda over apple pie for a savory-sweet contrast.

These three cheeses exemplify how cultural heritage and modern demand intersect in global production. While the U.S. leads in Cheddar and Mozzarella output, the Netherlands remains the undisputed king of Gouda. Together, these varieties account for a significant portion of the 22 million metric tons of cheese produced annually worldwide. Their dominance underscores a simple truth: in cheese, tradition and innovation are inseparable.

Round Cheese Blocks: Uncovering the Surprising Names Behind Circular Cheeses

You may want to see also

Explore related products

Export Leaders: EU countries lead in cheese exports, with France and Netherlands topping the list

The European Union dominates the global cheese export market, with France and the Netherlands emerging as the undisputed leaders. According to recent data, these two countries alone account for a significant portion of the world's cheese exports, showcasing the EU's unparalleled expertise in cheese production and distribution. France, renowned for its diverse cheese varieties like Brie, Camembert, and Roquefort, exports over 40% of its total cheese production, generating billions in revenue annually. The Netherlands, on the other hand, specializes in mass-produced cheeses such as Gouda and Edam, with exports reaching over 60% of its production, making it a key player in the global market.

To understand the EU's dominance, consider the following: the region's rich dairy heritage, combined with stringent quality control measures and favorable trade agreements, has enabled countries like France and the Netherlands to establish a strong foothold in international markets. For instance, the EU's Protected Designation of Origin (PDO) status ensures that traditional cheeses like France's Comté or the Netherlands' Old Amsterdam are produced according to strict guidelines, preserving their authenticity and appeal to discerning consumers worldwide. This focus on quality and tradition has allowed EU cheese exports to command premium prices, further solidifying their market leadership.

A comparative analysis reveals that while other countries, such as the United States and New Zealand, also produce substantial amounts of cheese, their export volumes pale in comparison to the EU leaders. The US, for example, exports only about 15% of its cheese production, primarily to neighboring countries like Mexico and Canada. In contrast, France and the Netherlands have successfully tapped into diverse markets, including Asia, where the growing middle class is developing a taste for premium European cheeses. This strategic market penetration, coupled with efficient logistics and strong branding, has enabled these countries to maintain their top positions.

For businesses and entrepreneurs looking to enter the cheese export market, there are valuable lessons to be learned from France and the Netherlands. First, invest in product differentiation by focusing on unique, high-quality cheeses that cater to specific consumer preferences. Second, leverage trade agreements and certifications like PDO to enhance product credibility and market access. Lastly, establish robust distribution networks to reach emerging markets, where demand for premium cheeses is on the rise. By adopting these strategies, exporters can emulate the success of the EU leaders and carve out their niche in this lucrative industry.

In conclusion, the EU's dominance in cheese exports, spearheaded by France and the Netherlands, is a testament to the region's ability to blend tradition, innovation, and strategic marketing. As global demand for cheese continues to grow, understanding the factors behind the success of these export leaders provides invaluable insights for anyone looking to thrive in this competitive market. Whether you're a producer, exporter, or simply a cheese enthusiast, the story of France and the Netherlands offers a compelling narrative of excellence and opportunity.

Flying with Cheese: Tips for Keeping Your Cool Dairy Fresh

You may want to see also

Consumption Trends: High production often correlates with domestic consumption and export demand

The United States leads global cheese production, with over 5.5 million metric tons annually, but this volume doesn’t solely reflect domestic appetite. While Americans consume approximately 16 kilograms of cheese per capita yearly, a significant portion of production fuels export markets, particularly in Asia and Latin America. This dual focus on internal demand and external trade underscores the country’s strategic positioning in the global dairy economy.

Consider the European Union, where Germany and France are top producers, collectively manufacturing over 4 million metric tons annually. Here, production aligns closely with cultural consumption habits—think France’s 27 kilograms per capita and Germany’s 25 kilograms. Yet, even these cheese-loving nations export surplus, particularly specialty varieties like Brie and Camembert, which command premium prices abroad. This interplay between tradition and trade highlights how domestic preferences shape production while export demand amplifies output.

For emerging producers like New Zealand, the dynamic shifts. Despite ranking lower in total production (around 500,000 metric tons), the country exports over 90% of its cheese, primarily to Asia and the Middle East. Domestic consumption hovers at a modest 10 kilograms per capita, revealing a production model driven almost entirely by external demand. This export-heavy strategy leverages New Zealand’s reputation for high-quality dairy, illustrating how smaller producers can thrive by targeting global markets rather than relying on local consumption.

To optimize cheese production strategies, producers should analyze consumption trends within their target demographics. For instance, younger consumers in export markets like China increasingly favor snackable, individually packaged cheeses, while older European consumers prioritize artisanal varieties. Pairing this data with trade agreements—such as the EU’s protected designation of origin (PDO) labels—can enhance market penetration. Practical tip: Invest in versatile production lines capable of switching between bulk and specialty products to balance domestic and export demands efficiently.

Ultimately, the correlation between high production and consumption trends isn’t one-size-fits-all. While the U.S. and EU blend domestic appetite with export growth, New Zealand’s model prioritizes international trade. Producers must tailor strategies to their market strengths, whether by leveraging cultural preferences, optimizing trade routes, or innovating product formats. Understanding these dynamics ensures sustainability in a competitive global cheese market.

Skim Mozzarella Cheese: Weight Watchers Points Breakdown and Tips

You may want to see also

Frequently asked questions

The United States is the largest producer of cheese globally, with an annual production of over 6 million metric tons.

In the United States, mozzarella and cheddar are the most commonly produced types of cheese, largely due to their popularity in pizzas and other dishes.

While the United States leads in total production, Europe collectively produces more diverse and specialized cheeses, with countries like Germany, France, and Italy being major contributors.

The United States' large dairy industry, advanced technology, and high domestic and international demand for cheese are key factors in its leading position.