The United States imports a variety of meats and cheeses from China, though the volume and types of these imports are relatively limited compared to other agricultural products. Chinese exports to the U.S. include processed meats like cured pork products and certain poultry items, as well as cheeses such as cheddar and mozzarella, often used in food manufacturing. However, these imports are subject to stringent U.S. food safety regulations and inspections to ensure compliance with health standards. Despite this, concerns about quality control and transparency in China’s food production processes have led to cautious consumer attitudes and relatively low import volumes in this category.

Explore related products

What You'll Learn

- Pork Imports: China exports significant amounts of pork products to the United States annually

- Beef Trade: Chinese beef imports to the U.S. are limited but growing in volume

- Chicken Exports: Processed chicken products from China are occasionally imported to the U.S

- Dairy Products: China supplies cheeses like cheddar and mozzarella to the U.S. market

- Regulatory Compliance: Imported meats and cheeses must meet strict U.S. food safety standards

Pork Imports: China exports significant amounts of pork products to the United States annually

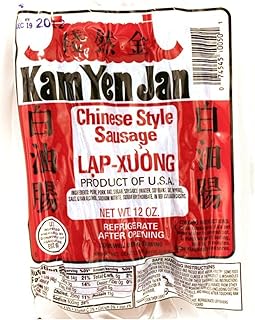

China's pork exports to the United States are a significant component of the global meat trade, with over 15% of U.S. pork imports originating from China in recent years. This statistic highlights the growing reliance on Chinese pork products, which include a variety of processed meats such as sausages, bacon, and canned pork. The U.S. Department of Agriculture (USDA) reports that China exported approximately 200,000 metric tons of pork to the United States in 2022, valued at over $400 million. These figures underscore the importance of understanding the types, quality, and safety standards of imported pork products.

Analyzing the trends, it’s evident that China’s pork exports to the U.S. are driven by cost-effectiveness and the ability to meet large-scale demand. Chinese pork products often come at a lower price point compared to domestically produced or other imported options, making them attractive to U.S. food manufacturers and retailers. However, this cost advantage raises questions about production practices, animal welfare, and adherence to U.S. food safety regulations. For instance, while the USDA’s Food Safety and Inspection Service (FSIS) oversees imported meat products, differences in inspection standards between the two countries can create gaps in quality assurance.

For consumers and businesses, navigating the complexities of Chinese pork imports requires vigilance. Practical tips include verifying FSIS approval on product labels, which ensures compliance with U.S. safety standards. Additionally, prioritizing transparency in supply chains by sourcing from reputable importers or opting for domestically produced pork can mitigate risks. For food manufacturers, conducting third-party audits of Chinese suppliers can provide an extra layer of assurance. It’s also advisable to stay informed about trade agreements and tariffs that may impact the availability and cost of Chinese pork products.

Comparatively, while China dominates in pork exports, other countries like Canada and Mexico remain the U.S.’s top suppliers due to geographic proximity and aligned regulatory frameworks. However, China’s role is unique in its scale and the challenges it presents. Unlike Canada or Mexico, China’s pork industry has faced issues such as African Swine Fever outbreaks, which have historically disrupted supply chains. Despite these challenges, China continues to be a key player in the U.S. pork market, particularly in processed and value-added products.

In conclusion, China’s significant pork exports to the United States offer both opportunities and challenges. While they provide cost-effective solutions for businesses, consumers and importers must prioritize safety and quality. By understanding the nuances of these imports and taking proactive measures, stakeholders can navigate this complex trade landscape effectively. As the global meat market evolves, staying informed and vigilant will remain crucial for ensuring the integrity of pork products entering the U.S. market.

Philly Cheese Steak Mishap: The Unexpected Rear-End Discovery Explained

You may want to see also

Beef Trade: Chinese beef imports to the U.S. are limited but growing in volume

Chinese beef imports to the U.S. remain a fraction of the total market, accounting for less than 1% of all beef consumed domestically. This limited presence is due to stringent U.S. Department of Agriculture (USDA) regulations, which only recently allowed Chinese beef to enter the country after a 14-year ban lifted in 2020. Despite this, the volume of Chinese beef imports is steadily increasing, driven by China’s growing herd size and its efforts to meet global food safety standards. For consumers, this means a gradual introduction of Chinese beef products, primarily in processed forms like jerky or frozen items, rather than fresh cuts.

Analyzing the growth trajectory, Chinese beef exports to the U.S. have risen by approximately 15% annually since 2020, though starting from a very low baseline. This increase is partly due to China’s strategic investments in modernizing its livestock industry, including improved breeding practices and disease control. However, challenges persist, such as U.S. consumer skepticism about food safety and the competitive pricing of domestic and other imported beef. Retailers and food service providers should monitor this trend, as Chinese beef could become a more viable option for cost-sensitive markets in the coming years.

From a practical standpoint, U.S. importers must navigate complex regulations to bring Chinese beef into the country. This includes ensuring compliance with USDA’s Veterinary Services requirements, such as traceability and residue testing for antibiotics and hormones. For businesses considering Chinese beef, partnering with reputable suppliers who adhere to these standards is critical. Additionally, marketing strategies should focus on transparency, highlighting certifications and safety measures to build consumer trust.

Comparatively, Chinese beef imports differ significantly from other meats and cheeses the U.S. sources from China, such as processed pork or goat cheese, which have faced fewer regulatory hurdles. Beef’s slower integration into the U.S. market underscores its unique challenges, including cultural perceptions and higher safety benchmarks. However, as China continues to expand its agricultural capabilities, its role in the global beef trade—and specifically the U.S. market—is poised to evolve, offering both opportunities and considerations for industry stakeholders.

Knoxville Cheesecake Factory Thanksgiving Hours: Open or Closed?

You may want to see also

Chicken Exports: Processed chicken products from China are occasionally imported to the U.S

Processed chicken products from China do make their way into the U.S. market, though not in large quantities compared to other imports. These products often include canned or packaged chicken, such as chicken nuggets, patties, or pre-cooked chicken strips. The U.S. Department of Agriculture (USDA) and the Food Safety and Inspection Service (FSIS) regulate these imports to ensure they meet American safety standards. Despite this, the volume remains relatively low due to logistical challenges, trade policies, and consumer preferences for domestically produced poultry.

From an analytical perspective, the occasional import of processed chicken from China highlights the complexities of global food supply chains. China’s poultry industry faces scrutiny over food safety concerns, including past incidents of contamination and antibiotic overuse. These issues have led to stricter U.S. inspections and limited the appeal of Chinese chicken products. Additionally, tariffs and trade tensions between the two nations further discourage large-scale imports. For consumers, this means Chinese chicken is rarely a primary choice, but it may appear in processed foods without explicit country-of-origin labeling, making awareness crucial.

If you’re concerned about the origin of processed chicken products, follow these practical steps: First, check labels for phrases like “Product of China” or “Imported.” Second, prioritize brands that emphasize domestic sourcing or transparency in their supply chain. Third, opt for fresh, unprocessed chicken when possible, as it’s less likely to be imported. Finally, stay informed about food safety recalls and updates from the USDA or FSIS to make educated purchasing decisions.

Comparatively, while the U.S. imports processed chicken from China, it relies more heavily on other countries like Canada, Mexico, and Brazil for poultry products. These nations have established trade relationships and meet U.S. safety standards more consistently. China’s role in the U.S. poultry market is thus niche, often limited to specific processed items rather than fresh or whole chicken. This contrast underscores the importance of understanding global trade dynamics when evaluating food imports.

In conclusion, while processed chicken products from China do enter the U.S., their presence is minimal and tightly regulated. Consumers can mitigate concerns by being vigilant about labels, choosing trusted brands, and favoring fresh options. As global trade continues to evolve, staying informed about the origins of food products remains essential for making safe and informed choices.

How Long Does Velveeta Cheese Last? Shelf Life Explained

You may want to see also

Explore related products

Dairy Products: China supplies cheeses like cheddar and mozzarella to the U.S. market

China's role in the U.S. dairy market is often overlooked, yet it supplies significant quantities of cheeses like cheddar and mozzarella to American consumers. These imports are not just bulk commodities; they are integral to the supply chains of food manufacturers, restaurants, and even retail outlets. For instance, shredded mozzarella from China is commonly used in frozen pizzas and pre-packaged meals, offering cost-effectiveness without compromising on taste or texture. This strategic sourcing allows U.S. businesses to maintain competitive pricing while meeting the high demand for dairy products.

Analyzing the logistics, China’s dairy exports to the U.S. are subject to stringent FDA regulations, ensuring they meet safety and quality standards. Despite this, the affordability of Chinese cheese makes it an attractive option for industries where profit margins are thin. However, this reliance raises questions about supply chain resilience, particularly in light of global disruptions like the COVID-19 pandemic. Businesses must weigh the benefits of cost savings against the risks of dependency on a single source, especially one as geographically distant as China.

From a consumer perspective, the presence of Chinese cheese in U.S. products is often invisible, as labeling requirements do not mandate country-of-origin disclosure for ingredients. This lack of transparency can be problematic for those with dietary restrictions or preferences, such as avoiding certain additives or supporting local agriculture. To navigate this, consumers should prioritize brands that offer detailed ingredient sourcing information or opt for products labeled "Made in the USA" when cheese origin is a concern.

A comparative look at Chinese and domestic cheese production reveals differences in scale and methodology. China’s dairy industry leverages large-scale manufacturing and lower labor costs to produce cheese competitively, whereas U.S. producers often emphasize artisanal methods and local sourcing. While Chinese cheese may not rival the complexity of American craft cheeses, its consistency and affordability make it a practical choice for mass-market applications. This duality highlights the importance of diversifying supply chains to balance cost, quality, and consumer expectations.

In conclusion, China’s supply of cheddar and mozzarella to the U.S. market is a nuanced issue, offering both opportunities and challenges. For businesses, it provides a cost-effective solution to meet demand, but it also necessitates careful risk management. Consumers, on the other hand, benefit from affordable dairy products but may need to be more vigilant about sourcing details. As the global dairy landscape evolves, understanding these dynamics is crucial for making informed decisions, whether in the boardroom or the grocery aisle.

Global Cheese Production: Which Country Leads in Annual Output?

You may want to see also

Regulatory Compliance: Imported meats and cheeses must meet strict U.S. food safety standards

The United States imports a variety of meats and cheeses from China, including pork, poultry, and processed cheese products. However, these imports are subject to stringent regulatory oversight to ensure they meet U.S. food safety standards. The Food Safety and Inspection Service (FSIS) under the USDA and the Food and Drug Administration (FDA) play critical roles in this process, inspecting and approving facilities, products, and processes before allowing entry into the U.S. market. For instance, Chinese pork exports to the U.S. must comply with specific residue testing for veterinary drugs and pathogens like Salmonella, mirroring the standards applied to domestically produced meats.

To achieve regulatory compliance, Chinese exporters must adhere to a multi-step process. First, their facilities undergo rigorous audits by U.S. authorities to verify sanitation, handling practices, and hazard analysis critical control points (HACCP) plans. Second, products are tested for contaminants, including heavy metals, pesticides, and antibiotics, with limits often stricter than those in China. For example, the maximum residue limit (MRL) for ractopamine in pork is 10 ppb in China but 0 ppb in the U.S., necessitating additional testing and segregation of supply chains. Failure to meet these standards results in shipment rejection or facility delisting.

From a practical standpoint, importers and consumers can take specific steps to ensure compliance. Importers should verify that Chinese suppliers hold valid FSIS or FDA export eligibility, which can be cross-referenced on the USDA’s public database. Consumers, while unable to directly verify compliance, can prioritize products with third-party certifications like BRCGS or SQF, which often align with U.S. standards. Additionally, checking country-of-origin labels and staying informed about FSIS import alerts can help avoid non-compliant products. For instance, a 2021 alert flagged Chinese poultry products due to avian influenza concerns, highlighting the dynamic nature of import regulations.

Comparatively, the U.S. regulatory framework for imported meats and cheeses is among the most stringent globally, surpassing even those of the EU in certain aspects. While the EU allows some antibiotics in livestock that are banned in the U.S., American standards prioritize zero tolerance for unapproved substances. This divergence underscores the importance of country-specific compliance strategies for Chinese exporters. For example, a Chinese cheese manufacturer exporting to both the U.S. and EU must maintain separate production lines to meet differing aflatoxin MRLs—5 ppb in the U.S. versus 0.05 ppb in the EU for certain cheeses.

In conclusion, regulatory compliance for imported meats and cheeses from China is a complex but essential process. It safeguards public health by ensuring products meet U.S. safety standards, which are among the strictest worldwide. For stakeholders, from exporters to consumers, understanding and adhering to these regulations is not just a legal requirement but a critical component of food safety. By staying informed and proactive, all parties can contribute to a safer, more transparent food supply chain.

Why Individually Wrapped Cheese is Labeled as Cheese Product

You may want to see also

Frequently asked questions

No, the United States does not import meats from China. Since 2007, the U.S. has banned the import of Chinese poultry due to safety concerns, and other meats are also not imported due to regulatory restrictions.

The U.S. imports very little, if any, cheese from China. Most cheese consumed in the U.S. is domestically produced or imported from countries like Italy, France, and Mexico.

While Chinese meat products are not imported, some processed foods containing meat or cheese ingredients may include components sourced from China. However, these are not direct imports of meats or cheeses.

The U.S. has strict food safety and import regulations, and China has faced scrutiny over food safety issues in the past. Additionally, domestic production and imports from other countries meet U.S. demand, reducing the need for Chinese imports.